Selling on Amazon? What Business Entity is Right for You?

Is Amazon a Good Place for Your Business?

If you sell something, almost anything, Amazon.com could be a great place to do it. It’s a huge marketplace, with more than 300 million active buyers using the site and, in 2019, more than 750,000 employees. The site had a net of $280.5 billion in sales in 2019. With more than 20 categories from books through electronics to food, if you have a product that can be shipped, Amazon could be the best marketplace for sales.

The size of the site and the number of sellers make product selection and market research critical, as the competition is intense. If you do your research and believe that you can serve a product niche on Amazon, then some consideration of the business entity you want to form is essential.

The “Test the Waters” New Amazon Business

If you’re unsure of your ability to compete on Amazon or whether your product(s) are in a successful niche on the site, then taking the Sole Proprietorship approach can work to start your online business. The sole proprietorship is fast, easy, has little paperwork, and you can concentrate on testing the Amazon waters.

If you are sure you have a marketable product, perhaps selling now on your website or a smaller competitor to Amazon, you can start as a sole proprietor and move into another entity later. Or, if you’re confident you’re going to grab a successful piece of the Amazon marketplace, then consider protections and other advantages offered by the LLC, Limited Liability Company, structure.

The LLC, Limited Liability Company, for Your Amazon Business

Amazon is competitive, and you’re in a worldwide marketplace. You are advertising products for sale with extensive product descriptions, statements of product advantages, benefits, or performance, as well as images. The advantages of forming an LLC include some protective features of this business entity. The LLC:

- It provides a legal separation of your personal assets from those of the business. Your assets are protected in the event of a lawsuit related to the company or your products.

- Your business presents a more established and professional image to potential customers. A business name separate from yours can help in building confidence when prospective buyers are comparing you to your competitors online. It’s easy for them to pull up vendor after vendor with similar products, maybe even the same products to make a buying decision.

- The LLC entity helps you to separate your personal and business finances. For tax filing and potential audits, you can then open bank and supplier accounts in the name of the company.

The LLC is inexpensive and straightforward to set up. It’s easy to manage, and reporting requirements for taxes are not extensive. The LLC offers some of the benefits of larger businesses and corporations without the expensive rules and regulations for government and tax compliance.

Another possible, but hopefully not inevitable, benefit of the LLC for your Amazon business is the protection of your name should it bomb. One thing you can’t manage on Amazon is the comments/reviews of customers.

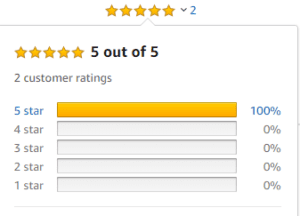

If you look for 100% perfect “5-star” reviews for a product, you’ll rarely find them unless it’s a new product on the site. As this image indicates, often, the first few reviews, up to around a dozen or so, are from friends and acquaintances of the seller. Feel free to do this as well, but know that as you begin to sell more, you’re going to get poor reviews. The fact is that some people aren’t even happy with perfection. Perfection is a perception.

As your sales mount, you can even try to reply to poor reviews and help with complaints, but you’ll find that some just will not be happy with anything you do.

If you’re not producing your product, or even if you are with parts or materials you buy from others, you are always at risk of quality issues, no matter how careful your process.

The point is that should you decide to bail on your Amazon business at some point and maybe start another one, or even another Amazon business, the LLC is the entity that left, not you personally.