Get a custom business tax plan that puts MONEY back into your business, our guarantee

A Kevin O’Leary Company

Business owners trust Tax Hive to help them get expert help with their tax game

Bryan F.

“Tax Hive found a bunch of stuff that my accountant had no clue about!”

Garrett R.

“If you’re a small business, you must do this, it’s very helpful.”

Junius B.

“I think Tax Hive in my opinion is the best.”

Angela C.

“My business is moving in the right direction and I’m really excited about what’s to come.”

Gladys T.

“These are experts, they know exactly what they’re doing.”

Rodney H.

“Tax Hive is essentially putting more cash-flow into your business.”

As of 9/5/25

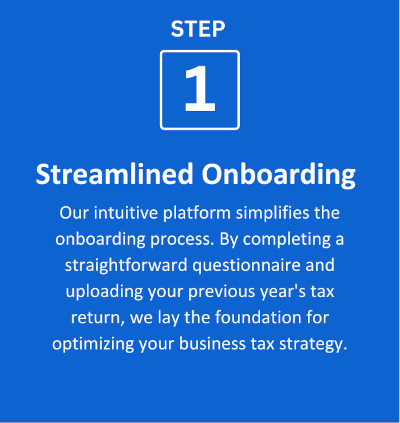

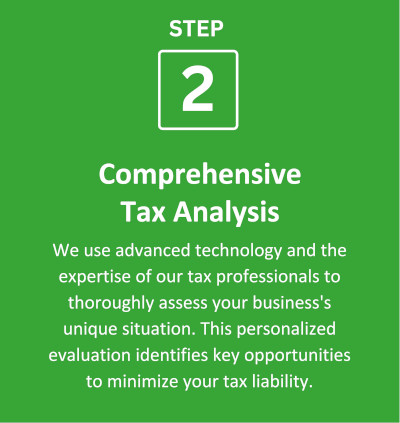

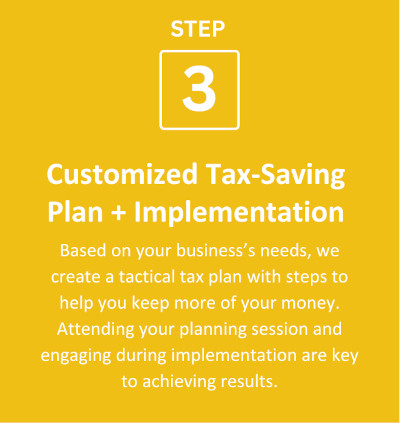

Our Triple Check Tax Plan™ makes saving on your taxes easier than ever before

Tax Hive guarantee

Our tax plan works, and we’ll prove it to you! We’re so sure you’re going to love your tax saving plan that we’ll refund up to 100% of the tax plan’s cost if we don’t find tax savings at least equal to the purchase price of the tax plan.

See why Kevin thinks our tax saving plan is right for your business

Select a day and time below for a FREE consultation to start saving money

Frequently asked questions

Why hasn’t my current accountant created a business tax savings plan for me?

We can’t speak for your accountant, but we find that many accountants are not qualified to create a comprehensive plan, they lack the time or staff to accomplish all that is necessary to take full advantage of a comprehensive plan or they are simply unaware they are not optimizing their clients’ businesses for tax savings (maybe ask them).

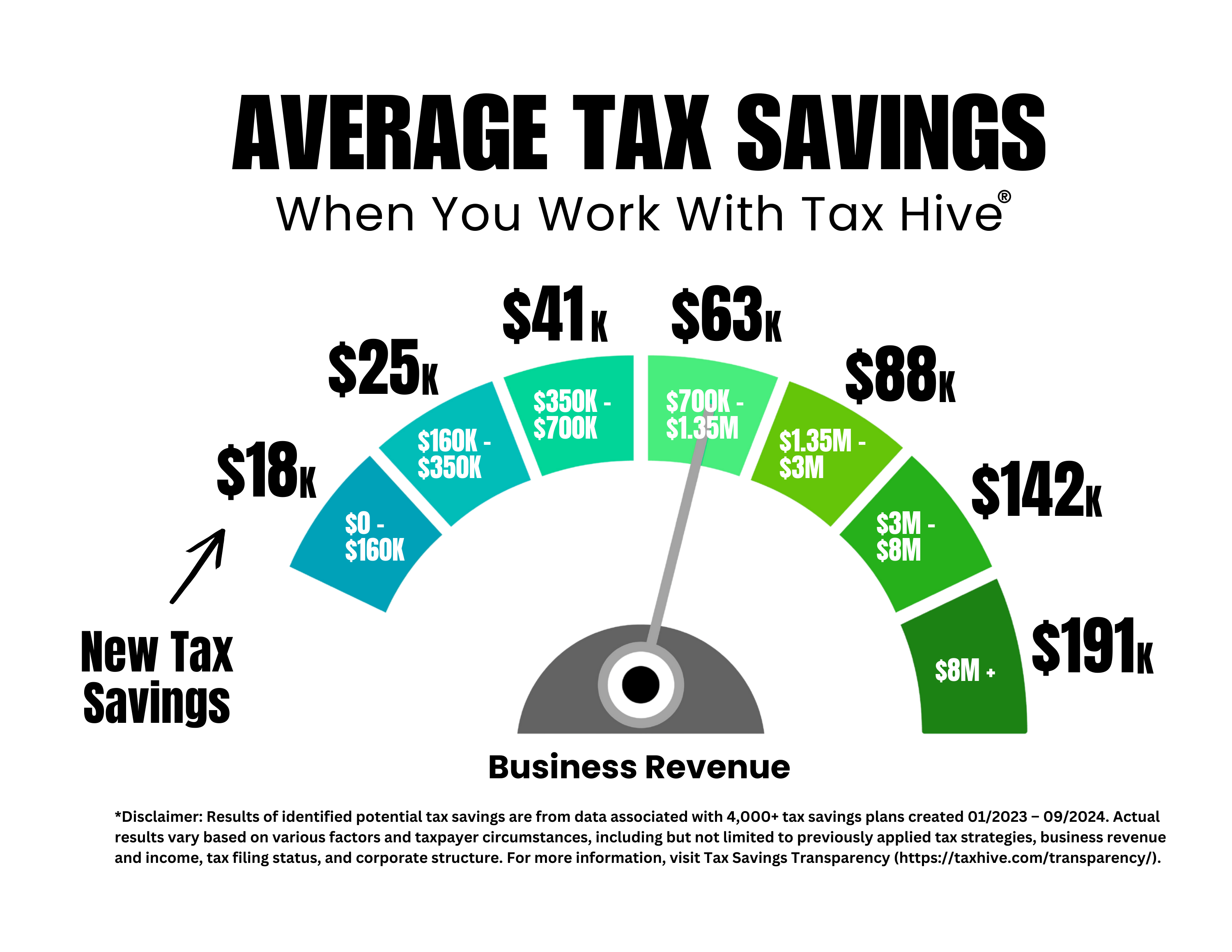

How much can I expect to save in taxes when I get a plan?

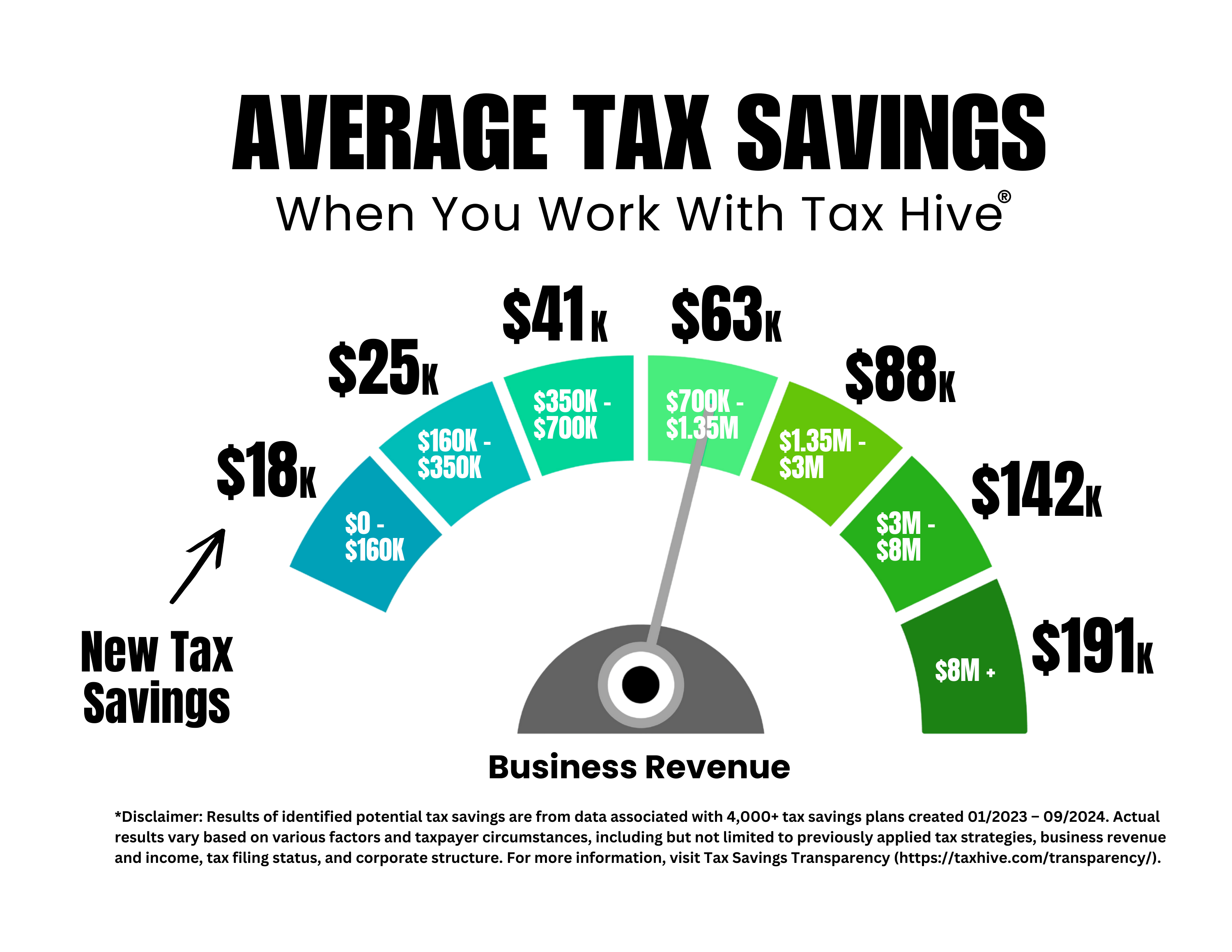

Because everyone’s situation is unique, we can’t promise you specific savings until reviewing your situation. However, the following graph can give you an idea of potential savings based on your annual business revenue.

What is the difference between the Strategic Tax Saving Plan and the Business Optimization Blueprint?

The Business Optimization Blueprint is a limited self-assessment designed to help you identify missing potential tax deductions. The result of the blueprint contains a list of missing potential tax deductions with pre-written answers reviewed and approved by licensed accounting and legal professionals. In 2022, we completed over 25,000 blueprints identifying an average in the tens of thousands per blueprint. In contrast, the Strategic Tax Plan is a comprehensive, strategic roadmap to overall tax savings (not just tax deductions). Our technology and team of experts consider thousands of tax strategy combinations. We review prior tax returns and check against 1,400 federal, state, and local tax deductions, credits, and programs. In 2022, our tax plans found an average estimated first year tax savings of $43,933. Schedule a free consultation today. Visit Tax Savings Transparency for more information.

Do I need an updated plan each year?

Because you, your business, and the tax code are constantly evolving and changing, we recommend you update your plan every year. Ask your account executive about discounted rates on updated plans.

Can I get a plan to see if my accountant is doing everything right?

Of course, we encourage it. Some of our clients simply want a “second opinion” to confirm their accountant, friend, or family member isn’t missing anything.

What if I have questions about getting a tax slashing plan?

We have a dedicated Account Executive Team that’s ready to help answer your questions. Schedule a call with us and we’ll be happy to answer all your questions.

What other business services does Tax Hive offer?

We offer traditional business tax preparation and tax filing services. In addition, we can help you with bookkeeping, audit response, entity formation, business cleanup, and business tax consulting and advice. We're here to help you keep your business moving forward.