The Tax Hive Free Tax Estimator Calculator is a user-friendly online tool designed to help business owners estimate their tax liabilities. By inputting basic financial information, users can quickly receive an approximation of their business tax obligations. This convenient resource aims to provide clarity and assist in financial planning, making tax time less stressful for entrepreneurs and business owners. This resource is not intended to be a replacement for expert tax advice. To view definitions for the terms used in this calculator, please click here.

Estimated (Quarterly) Tax Payments Calculator

Navigating the world of taxes can be complex, especially when it comes to estimated quarterly tax payments. Whether you’re a freelancer, small business owner, or have multiple sources of income, understanding and managing these payments is crucial.

Use our Estimated Quarterly Tax Payments Calculator to simplify the process and make accurate, timely payments.

What are estimated quarterly tax payments?

Estimated quarterly tax payments are payments made to the Internal Revenue Service (IRS) on income that isn’t subject to withholding taxes. This can include earnings from self-employment, interest, dividends, alimony, rent, gains from the sale of assets, prizes, and awards. Essentially, if you’re earning income that doesn’t have taxes automatically withheld, you’re likely required to pay estimated taxes quarterly to avoid penalties.

How does the estimated quarterly tax payments calculator work?

Our calculator factors your financial situation and IRS rules to calculate an estimate of annual tax payments and balance due. It is based on your entries and could change once other data and documentation are provided.

Who needs to make estimated quarterly tax payments?

Estimated tax payments are typically required for individuals who earn income that is not subject to withholding. This includes earnings from self-employment, interest, dividends, rents, alimony, and other sources. The IRS mandates estimated tax payments for these types of income to ensure that taxpayers are covering their tax liability throughout the year rather than paying everything at once at the end of the year.

The requirement for making estimated tax payments generally applies if you expect to owe at least $1,000 in federal tax after subtracting your withholding and credits, and you expect your withholding and credits to be less than the smaller of 90% of the tax to be shown on your current year’s tax return, or 100% of the tax shown on your previous year’s tax return.

Here are some key points about who needs to make estimated tax payments:

- Self-Employed Individuals: If you are self-employed, you are likely required to make estimated tax payments. This includes freelancers, independent contractors, and small business owners.

- Individuals with Other Sources of Income: If you have income from sources such as interest, dividends, alimony, rent, gains from the sale of assets, prizes, or awards, you may need to make estimated tax payments.

- Taxpayers with Insufficient Withholding: If you are an employee but do not have enough tax withheld from your paycheck or if you have other sources of income on top of your salary, you might need to make estimated tax payments.

- Certain Corporations: Corporations, especially those expecting to owe $500 or more in taxes, typically need to make estimated tax payments.

How to calculate estimated quarterly taxes

Use our calculator

Our Estimated Quarterly Tax Payments Calculator simplifies the estimation process. By inputting your expected annual income, deductions, and credits, the calculator provides an estimated tax payment amount due for the period.

Do it yourself

- Step 1: Estimate taxable income for the year

Start by estimating your total income for the year. This includes all your earnings minus any deductions and exemptions. - Step 2: Calculate income tax

Based on your estimated taxable income, use the current IRS tax brackets to calculate your income tax. You can find your tax bracket using NerdWallet’s 2023-2024 Tax Brackets and Federal Income Tax Rates table. - Step 3: Calculate self-employment tax

If you’re self-employed, calculate your self-employment tax, which covers Social Security and Medicare taxes. The self-employment tax rate is 15.3% of net income. - Step 4: Add it all together, and divide by four

Combine your income tax and self-employment tax, then divide this total by four to get your estimated payment for each quarter.

When are estimated quarterly tax payments due in 2024?

Estimated tax payments are due four times a year. The specific due dates typically fall around mid-April, mid-June, mid-September, and mid-January.

- April 15, 2024

- June 17, 2024

- September 16, 2024

- January 15, 2025

How to make estimated quarterly tax payments

Option 1: Get a Tax Hive professional’s help

Tax Hive professionals can help you accurately calculate your estimated quarterly tax payments by considering various factors like your income, deductions, credits, and any recent changes in tax laws to ensure you pay the correct amount. If you have a complex financial situation, such as multiple income streams, investments, or rental properties, or if you’re self-employed, you may want a tax professional to help.

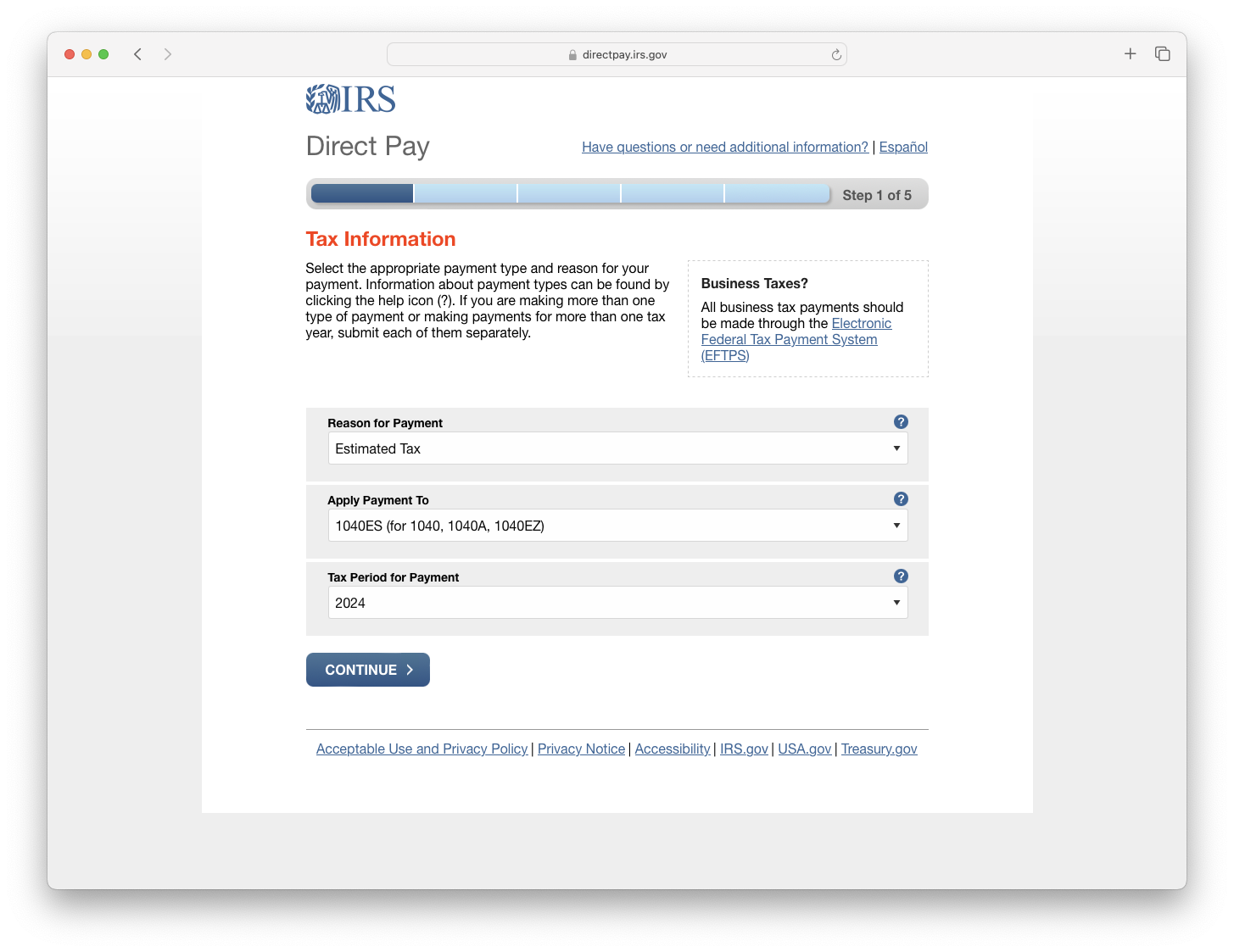

Option 2: Direct Pay

IRS Direct Pay is a convenient, secure, and fee-free method for paying taxes online directly from your bank account. It’s ideal for those seeking a quick and straightforward payment process without the need to create an account or remember additional logins. This service is particularly useful for last-minute payments, offering immediate confirmation and a hassle-free experience while ensuring the safety of your personal information.

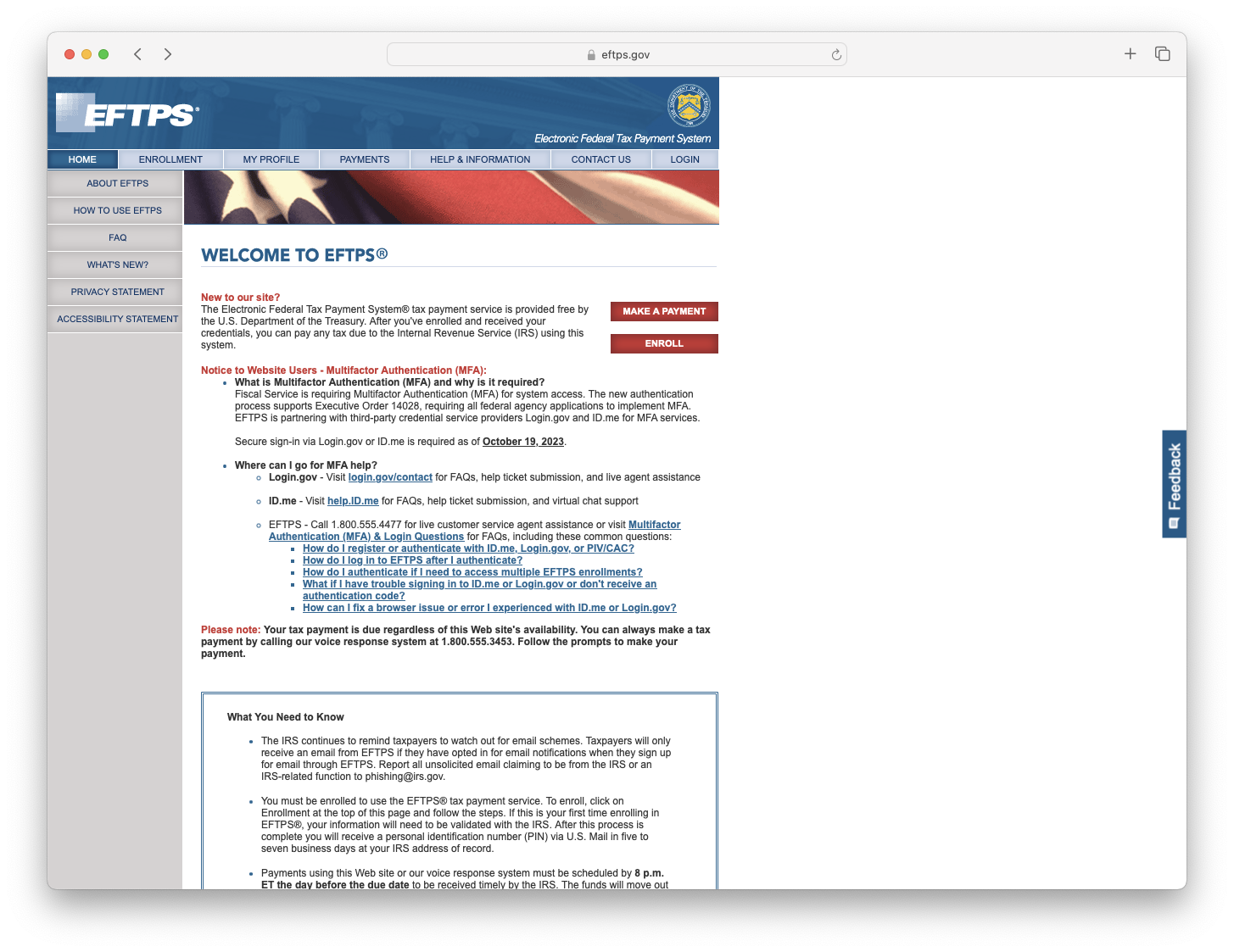

Option 3: An EFTPS account

Paying estimated taxes using an EFTPS (Electronic Federal Tax Payment System) account is highly efficient for those seeking control and flexibility in managing tax payments. It’s particularly suited for individuals who prefer scheduling payments in advance and tracking their payment history online. EFTPS provides a secure, government-run system, ensuring reliability and peace of mind. This method is ideal for both individuals and businesses looking for a consistent, organized approach to handling their tax obligations.

Option 4: Mobile App (IRS2Go)

Paying estimated taxes through the IRS-approved mobile app (IRS2Go) is a great choice for those who value convenience and speed. It’s ideal for tech-savvy individuals who prefer handling financial tasks on the go. With a few taps on your smartphone, you can easily pay your taxes anytime and anywhere without the need for a computer or physical mail. This method offers a user-friendly interface, instant payment confirmations, and the ability to keep track of your payments directly from your phone.

Option 5: Phone Payments

Paying estimated taxes by phone is an excellent option for those who prefer the simplicity and directness of speaking to a representative or following voice prompts, especially if they are not comfortable with online transactions or lack internet access. It’s a straightforward and accessible method, offering security and the convenience of immediate assistance and verbal confirmation, ideal for individuals who don’t use advanced technology or are wary of online security.

Option 6: Physical Check

Paying taxes by check is a traditional, straightforward method for those who prefer tangible records and are hesitant about online transactions. It’s slower than digital methods but offers a clear, documented trail for your records, making it a reliable choice for those less comfortable with technology.

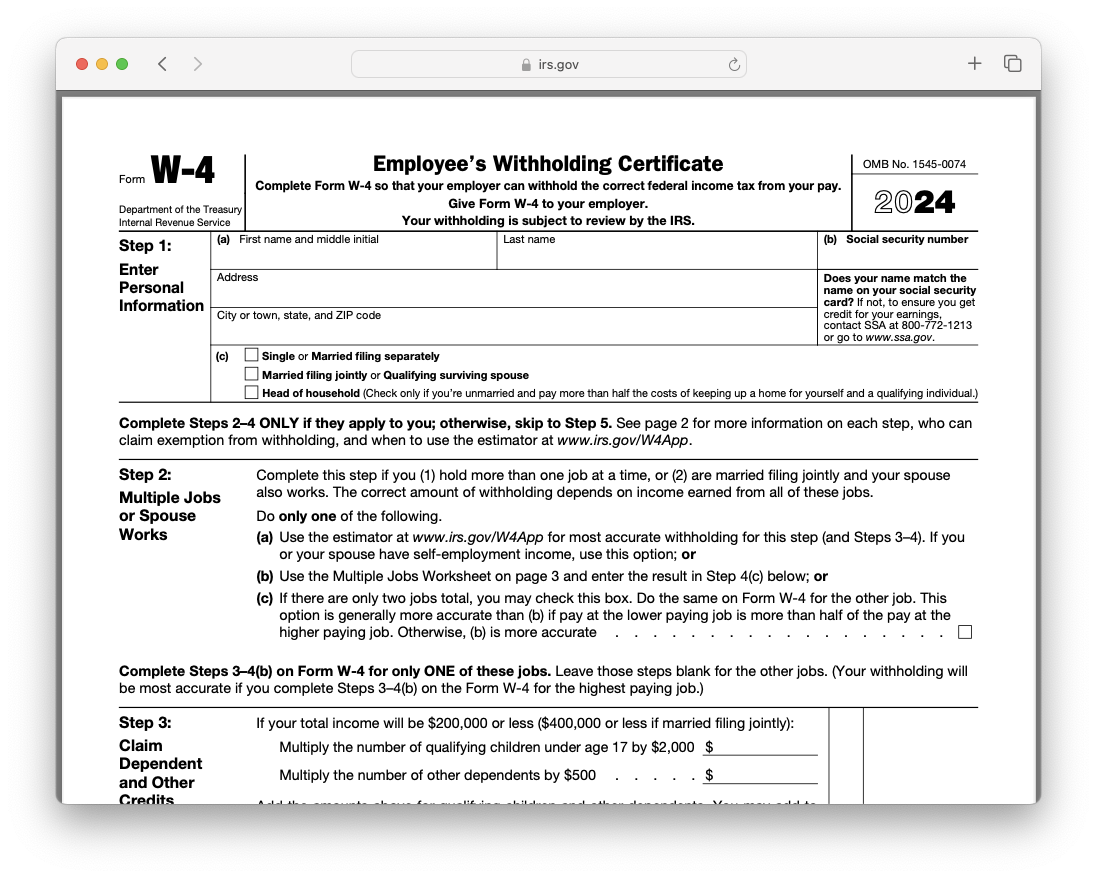

Option 7: Increasing W-2 Withholdings

Paying estimated taxes by increasing W-2 withholdings is an efficient method for employed individuals. It streamlines tax payments by adjusting the tax amount withheld from your regular paycheck, reducing the need for separate quarterly payments. This approach is particularly convenient for those who prefer a set-and-forget method, ensuring tax obligations are met seamlessly throughout the year. Complete the IRS Form W-4 for your employer to withhold the correct federal income tax from your pay.

Why should you make quarterly tax payments?

Penalty Avoidance

Making quarterly estimated tax payments is crucial primarily to avoid penalties. The IRS requires that taxes on income not subject to withholding be paid as you earn it throughout the year. Failing to do so can result in underpayment penalties, which are essentially interest charges on the amount not paid on time. By making these payments quarterly, you ensure that you’re covering your tax liability as you go rather than facing a large bill and potential penalties at the end of the year. This approach helps maintain compliance with tax laws and avoids the added financial burden of penalties, making your overall tax management more predictable and stress-free.Top of Form

Peace of Mind

Paying your taxes through quarterly estimated payments offers significant peace of mind. It allows you to spread your tax liability throughout the year, avoiding the stress of a large lump-sum payment at tax time. This method of regular, smaller payments helps in better managing your cash flow and budgeting, reducing financial anxiety. Knowing that you are staying on top of your tax obligations consistently also alleviates the worry of falling behind or encountering unexpected debts during the annual tax filing season. In essence, it ensures a more controlled and predictable financial planning approach, giving you a clearer and more relaxed mindset regarding your tax responsibilities.

Improved Financial Focus

Paying estimated taxes quarterly helps in developing better financial management habits. This regular payment schedule prompts you to monitor your income and expenses more closely, leading to more disciplined budgeting and financial planning. By consistently setting aside money for taxes, you enhance your overall financial awareness and preparedness, contributing to a more stable financial situation.

The “Safe Harbor” Rule

The “safe harbor” rule in the context of quarterly estimated tax payments is an IRS guideline that helps taxpayers avoid penalties. According to this rule, if you pay either 90% of the tax you owe for the current year or 100% of the tax you paid the previous year (110% if your adjusted gross income is more than $150,000), you won’t face underpayment penalties, regardless of how much you owe when you file. Making quarterly estimated tax payments using the safe harbor rule ensures you meet these minimum requirements, providing relief from the worry of calculating exact amounts due each quarter. It simplifies tax planning, especially for those with fluctuating incomes, and offers a buffer against potential penalties.

How do I lower my taxes?

Partnering with Tax Hive can be a strategic move to help lower your tax liability and manage estimated quarterly taxes. Tax Professionals can help with tax savings plans and bookkeeping to identify potential deductions and credits you might be missing, ensuring you’re not overpaying on taxes. Schedule a free consultation to learn more about how Tax Hive can help.

To lower your taxes without professional help, consider these straightforward strategies: Increase contributions to retirement accounts like 401(k)s or IRAs to reduce taxable income. Use Health Savings Accounts if eligible, as they offer tax-free contributions and withdrawals for medical expenses. Take advantage of tax credits such as the Earned Income Tax Credit and Child Tax Credit, which directly reduce your tax bill. Itemize deductions if they exceed the standard deduction, focusing on expenses like mortgage interest and charitable donations. Lastly, adjust your tax withholdings to match your actual tax liability better, avoiding giving an interest-free loan to the government.Top of Form

FAQs

What are estimated quarterly tax payments?

Estimated quarterly tax payments are payments made to the IRS four times a year by individuals who earn income not subject to withholding taxes, like earnings from self-employment, interest, dividends, and rent. These payments cover your tax liability for income earned during each quarter.

At what income should I pay quarterly taxes?

You should pay quarterly taxes if you expect to owe at least $1,000 in taxes for the year after subtracting withholdings and credits, and you anticipate that your withholding and credits will be less than either 90% of the tax to be shown on your current year’s tax return, or 100% of the tax shown on your previous year’s return (110% if your adjusted gross income is more than $150,000).

How much should I save for quarterly taxes?

To estimate how much to save for quarterly taxes, calculate your expected annual income, subtract any deductions and credits, and then apply the appropriate tax rate to determine your estimated tax liability. Divide this amount by four to get the amount for each quarterly payment. A general rule is to set aside 25-30% of your income for taxes, but this may vary based on your specific tax situation and income level.

How do you calculate quarterly estimated taxes?

To calculate quarterly estimated taxes, estimate your total annual taxable income, including self-employment, interest, dividends, and other sources. Subtract deductions and apply the relevant tax rate to find your total tax liability. Then, divide this number by four to get the amount for each quarterly payment. Remember to account for any credits and previous tax payments to avoid overpaying or underpaying.

When are estimated tax payments due in 2024?

In 2024, estimated tax payments are due on April 15, June 17 (since June 15 falls on a weekend), September 16 (as September 15 is a Sunday), and January 15, 2025. These dates are the standard deadlines for making quarterly estimated tax payments to the IRS.

How do I file quarterly estimated taxes?

To file quarterly estimated taxes, fill out Form 1040-ES, which includes a worksheet to help calculate your estimated tax liability. Once calculated, you can make payments online via the IRS Direct Pay, the Electronic Federal Tax Payment System (EFTPS), by phone, or through mail with a check or money order. Keep records of each payment for your annual tax return.

Do quarterly tax payments need to be in equal amounts?

No, quarterly tax payments do not need to be in equal amounts. While many people choose to pay equal amounts for simplicity, you can adjust the payments if your income varies throughout the year. Just ensure that by the end of the year, you’ve paid enough to avoid underpayment penalties, either through these payments or withholdings.

Are self-employed people required to pay estimated taxes?

Yes, self-employed individuals are typically required to pay estimated taxes because they don’t have taxes withheld from paychecks like traditional employees. If you expect to owe $1,000 or more in taxes for the year after subtracting credits and withholdings, you should make quarterly estimated tax payments to cover your tax liability. This includes income tax and self-employment tax, which covers Social Security and Medicare contributions for self-employed individuals.

What happens if I miss a quarterly estimated tax payment?

If you miss a quarterly estimated tax payment, you may be subject to underpayment penalties and interest charges. The IRS calculates these penalties based on the amount you underpaid and the time it was unpaid. To mitigate this, make the missed payment as soon as possible to reduce penalties. It’s essential to stay on top of your estimated tax payments to avoid unnecessary financial penalties and ensure compliance with tax obligations.

Can I make estimated quarterly payments with a credit card?

Yes, you can make estimated quarterly tax payments with a credit card. The IRS accepts tax payments via credit or debit cards through authorized payment processors. However, be aware that credit card payments may incur a processing fee, which varies depending on the payment processor. It’s essential to factor in this fee when making payments and consider whether the rewards or benefits offered by your credit card outweigh the cost of the fee. Additionally, ensure that the payment processor you choose is approved by the IRS to avoid potential issues with your tax payments.

What payment methods can I use to pay my estimated quarterly tax payments?

You have several options for paying your estimated quarterly tax payments. You can pay online through the IRS’s Direct Pay or enroll in the Electronic Federal Tax Payment System (EFTPS) for secure bank transfers. Alternatively, you can use a credit or debit card, but be aware of associated processing fees. Mobile apps like IRS2Go provide convenient payment options via your smartphone. If you prefer, you can make payments over the phone, although this may also involve fees. Another traditional method is to send a check or money order by mail, ensuring it reaches the correct IRS address. Lastly, consider adjusting your W-4 form with your employer to increase withholding from your paycheck to cover your estimated taxes. Each method caters to different preferences and situations, so choose the one that suits you best.

Disclaimer

This article provides general information and should not be considered professional tax advice. Tax laws and regulations can change, and individual circumstances vary, so it is crucial to consult with a qualified tax professional or the IRS for personalized guidance and to ensure compliance with current tax laws. The information presented here is accurate to the best of our knowledge at the time of writing but may not reflect the most current tax regulations or interpretations. Readers are encouraged to seek professional assistance for their specific tax situations.

Qualifying Children – Qualifying children includes any child under the age of 19 (24 if a full-time student, or any age if permanently and totally disabled), who lived with you for at least half the year, for whom you provided at least half their support, and they are your child, grandchild, stepchild, adopted child, foster child, sibling, half-sibling, step-sibling, niece, or nephew.

Qualifying Others – Qualifying others includes any dependent for whom you provide more than half their financial support, earns less than $4700 in 2023, and does not qualify as a qualifying child.

Business Income – This includes any income from businesses you actively or passively own (except for rental income and investments through stock)

Passive Rental Income – Passive rental income includes any income from short term or long term rentals you own and did not report under business income. Please note you cannot claim losses for these activities unless they are a short-term rental you actively manage or you qualify as a real estate professional. If you cannot qualify for either of those, please enter $0 or the calculation will be off.

W2 Income – W2 income includes all your earnings from jobs you work as well as from companies you own unless that income is reported in business income

Taxable Interest and Ordinary Dividends – Please exclude dividends you know qualify for capital gains treatment. Those should be reported under capital gains. All other income from dividends or interest should be reported here.

Taxable Retirement Account Distributions – This includes all income from retirement accounts except Roth style accounts. In other words include taxable distributions and exclude nontaxable distributions.

Other Taxable Income – Please do not include capital gains or income from other areas.

Short-term Capital Gains – These are capital gains income from assets you owned for less than one year.

Long-term Capital Gains – These are capital gains income from assets you owned for longer than one year, including most qualifying dividends.

Itemized Deductions – Please enter your amount of itemized deductions if you intend to use the itemized deductions instead of the standard deduction

Tax Deductions – Exclude dependent and child tax credits, meaning everything but the $2000 and $500 credits you will receive for your qualifying children and qualifying dependents. Those will be calculated for you.

Social Security Withholdings – Please enter all amounts withheld through W2s, 1099s, or other sources for your federal withholdings. These do not include your tax payments, but would include other amounts that count as payment of your tax liability.

Tax Payments – Please include all estimated tax payments you made to the IRS to cover your tax liability this year.

Ordinary Income – This includes all your income except capital gains income

Capital Gains Income – This includes your capital gains income

Ordinary Tax – This is your estimated tax on ordinary income

Capital Gains Tax – This is your estimated tax on capital gains.

Credits and Payments – This includes credits and payments you should receive to bring down your tax liability.

Balance Due – This is the balance you should pay to the IRS to cover what is estimated to be your liability based on your entries.