“Finally a tax-slashing roadmap that

puts money back into your business”

Our Triple Check Tax PlanTM makes saving

on your taxes easier than ever before

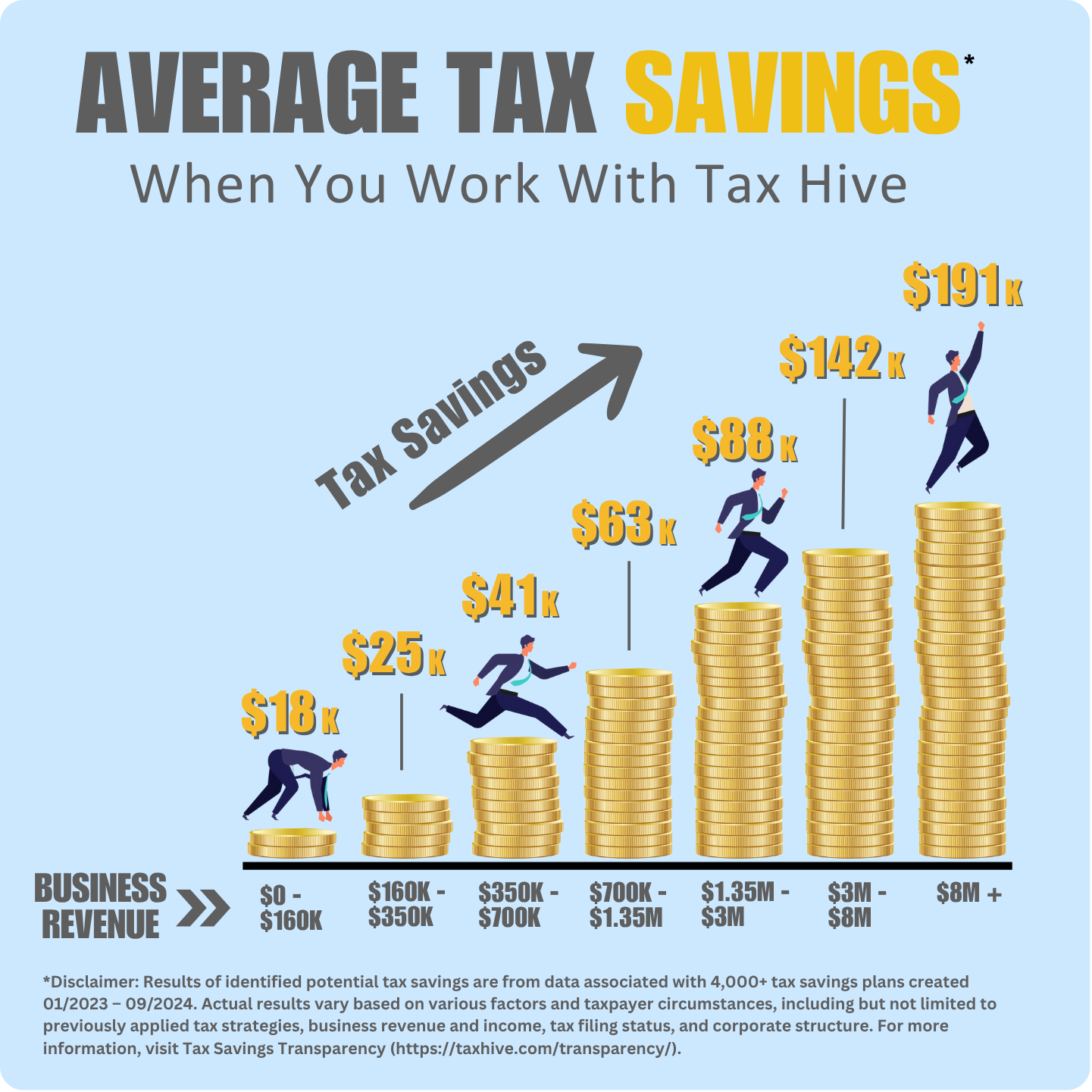

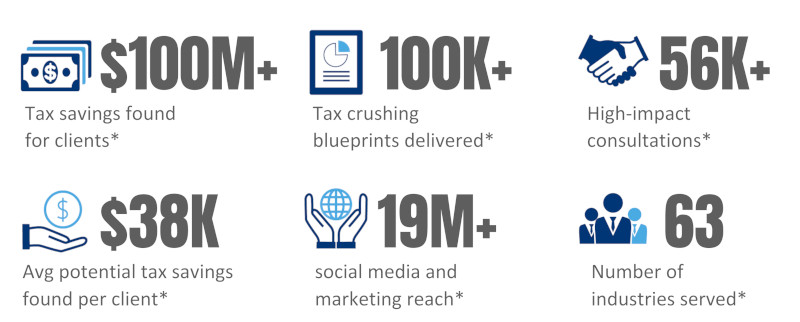

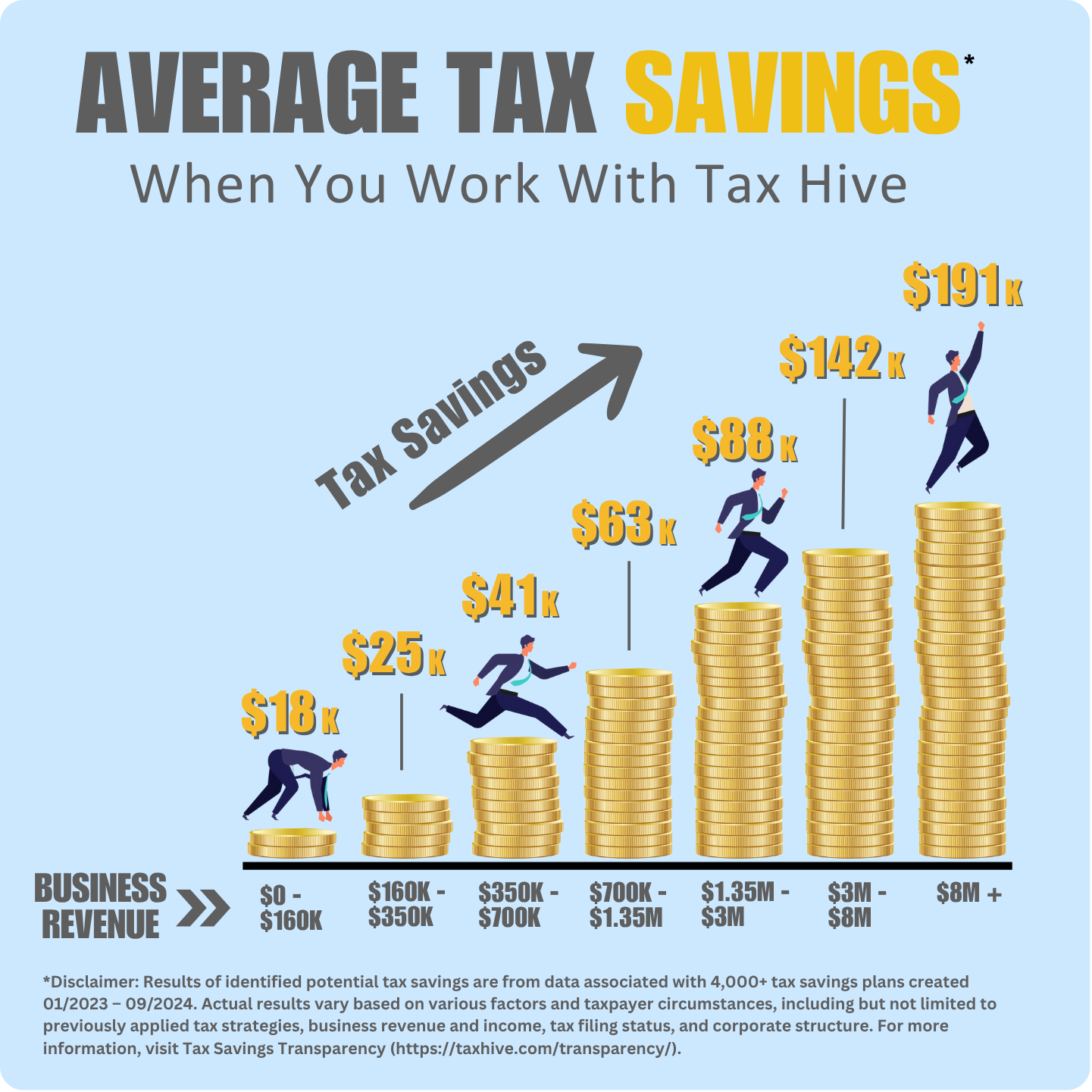

You should know—we are

helping our clients find savings

"Failing to plan for your taxes is planning to lose money. The opportunities for savings are there, but only if you take action."— Kevin O'Leary

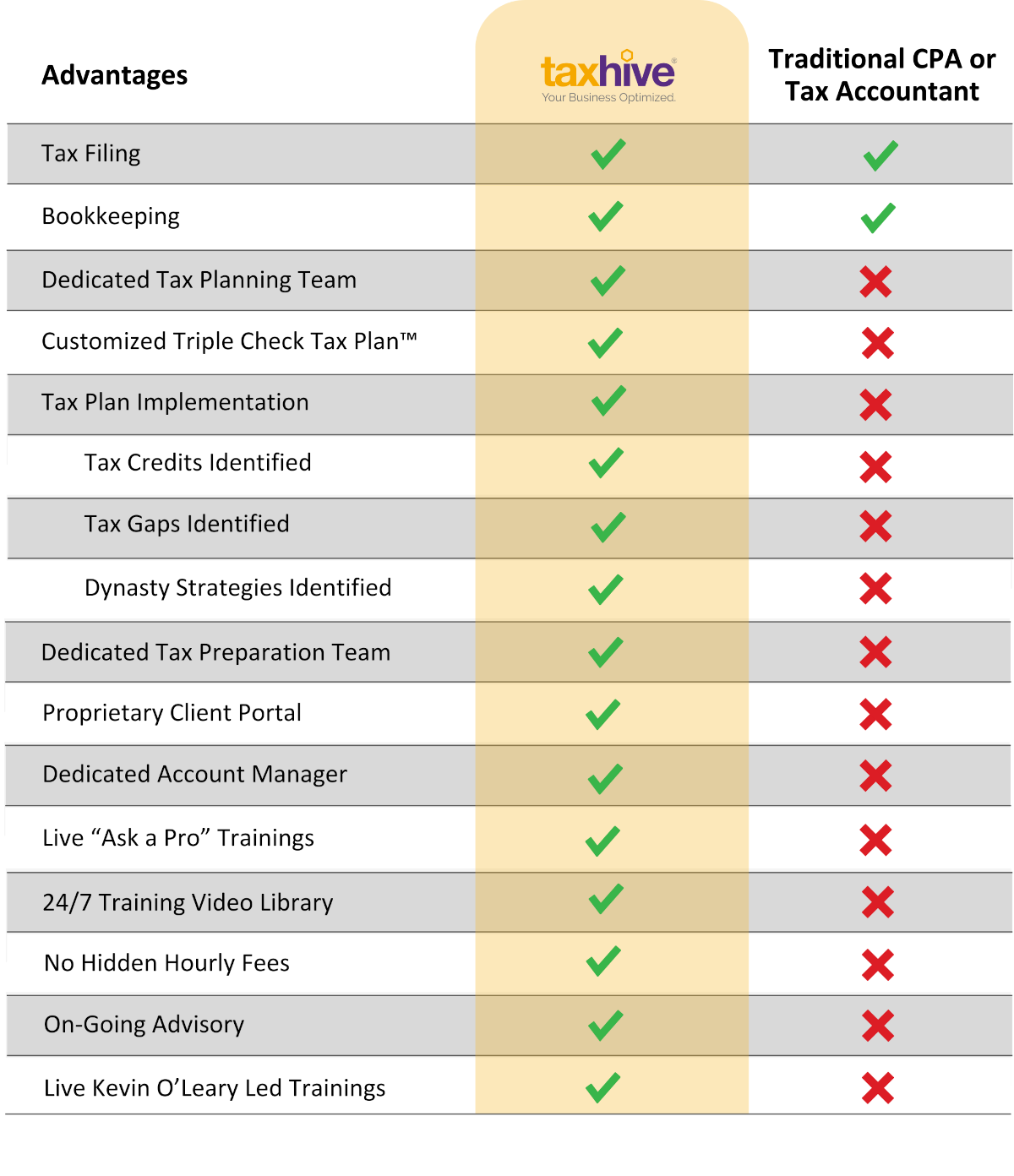

What makes us better

than the other guys?

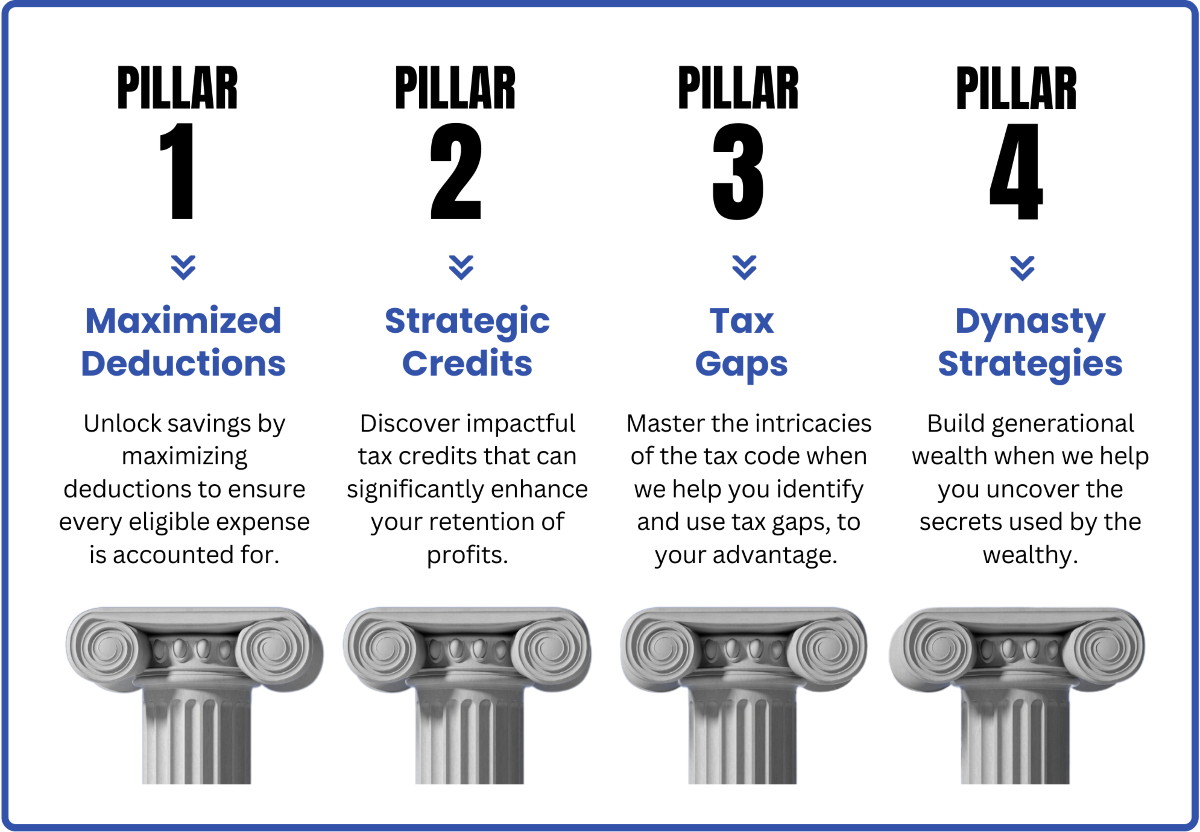

The 4 pillars to supercharge your tax savings

How does our tax plan help maximize your overall tax strategy?

Our tax plan uses four pillars—maximized deductions, strategic credits, tax gaps, and dynasty strategies—to enhance your tax strategy. By applying these pillars, we aim to optimize your tax savings now and preserve wealth for the future.

Here’s a sample snapshot of a strategic plan

What makes a happy Tax Hive client?

(The road you choose really does matter)

What our clients are saying

"Tax Hive gathered my information and documents and gave me a list of several actions which will save me thousands in taxes."

"I have to admit, I was a bit skeptical about dealing with Tax Hive, But I tell you, Tax Hive is by far the best tax firm which I have come across."

"Tax Hive has been amazing in metting all our small business tax needs. Their expertise has made our tax process seamless."

Trusted by thousands of satisfied

small business owners

Win-Win Guarantee!

Our plan works, and we'll prove it to you! We're so sure you're going to love your tax-saving plan that we'll refund up to 100% of the plan's cost if we don't find savings at least equal to the purchase price of the plan.

✝ Conditions applyTax Hive client success stories

The support you need,

when you need it

All Tax Hive clients have access to:

- A dedicated account manager

- Assigned tax advisor

- Live answer during business hours

- Ongoing "Ask a Pro" support

See how our tax advisors feel

about the clients we serve

"Our customer is our greatest asset"

"As the senior Tax Advisor at Tax Hive, it's my pleasure to serve our amazing clients. I love seeing how successful they are, and it's incredibly rewarding to play a part in helping them achieve their goals."

"The business owners we support are not only dedicated but incredibly inspiring, and it's a pleasure to collaborate with them. Every day, I'm excited to help these entrepreneurs maximize their tax savings and drive real financial growth. It's fulfilling to know that the work we do makes such a positive impact on their businesses."

"Before coming to Tax Hive I worked for a number of other Tax Service companies, and I have to say that the clients we work with here at Tax Hive are just incredible. I look forward to coming to work every day and helping small business owners add more dollars to their bottom line. Thank you, thank you!"

Corporate offices—real people

doing real work for real businesses

Frequently asked questions