Can I Pay My Taxes with a Credit Card (For Rewards)?

We’ll begin this article with the title and that you’re not paying taxes with a credit card because you don’t have the money to pay, and you’re late. It can be an excellent decision to avoid 25% tax penalties in exchange for 16% credit card interest. You may also find that an IRS approved installment plan may work better for you. That said, this is about paying taxes with a credit card for rewards or bonuses offered by the card issuer.

The IRS Lets You Pay with a Card

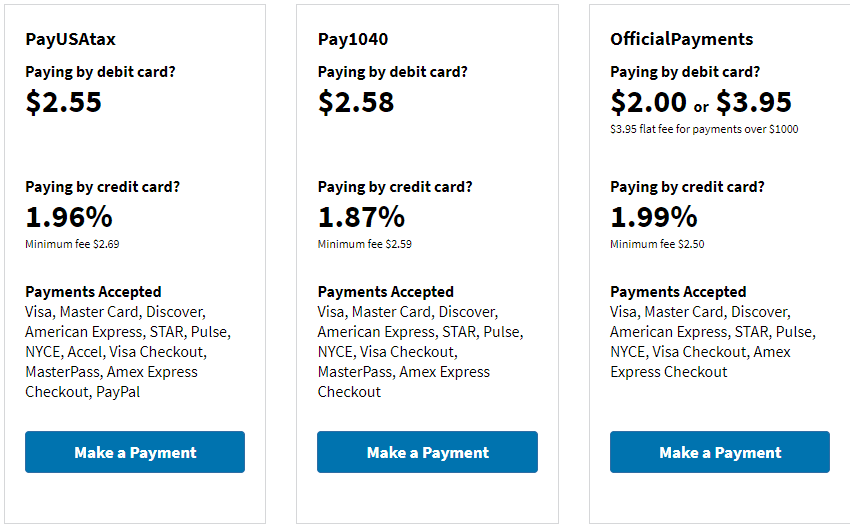

The IRS does allow paying with a credit card, but they limit the payment though three card payment processors. Here are the companies and their rates.

Those 2% +/- fees are in addition to any fees or interest the credit card issuer may charge. Now that the costs are identified, the task is to evaluate any card offers, perks, or rewards. In many cases, the value of the rewards isn’t equal to the 2% fee with the IRS plus any interest or cash advance fees you may pay. In other cases, you may find that you’ll make money on the deal, and some of those examples follow.

You can’t use the card for every payment type.

You can’t use the card for all IRS forms or payments. You can’t pay quarterly tax payments with a card. There are also limits to how frequently you can use a card for payments.

If you have past tax debt and the IRS files liens against you, they may not be released as soon as you may like after payment with a credit card. However, as this article is about using a card for rewards, it’s just good information to know.

Examples of How Using a Card for Rewards Could Work for You

Some cards offer a signup bonus that is large but require large charges within a short period after the card is issued. Often, for charging an example $5,000 within 60 days, the new cardholder may get a major points reward or very high airline mileage reward. If the points or miles are worth more than the 2% or so fee you pay for the IRS processing, it may be a good way to go, especially if you pay off the balance before you’re charged significant interest.

Another example would be a recent offer for signing up for the American Express Business Platinum Card. The recent Welcome Bonus offer stated: Earn up to 75,000 points — earn 50,000 Membership Rewards® points after you spend $10,000 and an extra 25,000 points after you spend an additional $10,000 all on qualifying purchases within your first 3 months of card membership. If your tax bill is $10,000 or $20,000 or more, that’s a lot of points for the money you were going to pay Uncle Sam anyway.

At any time you look, there are many of these offers out there. If you have a tax bill, and especially if you have the money to pay it anyway, they could be right for you. Get the new card, the fantastic points reward, then pay it off.