How To File a Business Tax Extension in 2022

As a business owner, you need to keep track of important dates throughout the year. Few are more important than income and payroll tax filings and quarterly estimated payments. Other dates like open enrollment and holiday parties are important too, but they’re probably more fun. When it comes to filing business income tax forms, the deadline has a way of quickly sneaking up. Many business owners choose to file an extension to take advantage of new tax laws or to double or triple check their maximizing tax deductions and credits. Keep in mind you’re your tax extension is for the return – not for payment of any taxes you might owe.

You may have heard rumors that you’re more likely to be audited if you file early or on-time than if you file an extension and taxes later. You shouldn’t base a decision to file for an extension on fear of an audit. That is, unless you need time to make certain that your return is accurate and you’ve paid the correct amount of taxes you owed.

Special Business Tax Extensions Available for 2022 Filing

There are a couple of special business tax extensions available for 2022.

Businesses hurt by the winter storms in Illinois, Tennessee, and Kentucky

Businesses qualified as having been impacted by the severe 2021 winter storms in Kentucky, Illinois, and Tennessee automatically have extensions until May 15, 2022, to file their 2021 business tax returns. This includes returns originally due on March 15 and April 18, 2022. The IRS stated they would work with businesses outside the affected area but had their tax records stored in that area.

Businesses impacted by the winter storms or wildfires in Colorado

FEMA designated counties in Colorado impacted by winter storms or wildfires in 2021 in Colorado. Businesses in those counties received an automatic extension for filing their 2021 business tax returns until May 16, 2022. If your business is not located in the designated counties but had tax records stored there, you can contact the IRS to request relief.

Patriot’s Day in Maine and Massachusetts

Two states, Maine and Massachusetts, celebrate Patriot’s Day on April 18, 2022, so the deadline to file is pushed to April 19, 2022.

Regular Business Tax Extension for Filing 2021 Return in 2022

Businesses can file for a six-month extension to file their 2021 return. Tax returns due on March 15, 2022 will receive an extension to file until September 15, 2022. For returns due on April 18, 2022, the extension to file will be until October 17, 2022.

Remember that the time extension is only for the tax return filing, not for tax payments you might owe. You must pay any taxes owed by the original due date to avoid penalties and interest.

The PROs and CONs of Business Tax Extensions

Sometimes filing tax extensions becomes a business habit, even when unnecessary. Here are some PROs and CONs for decision-making.

| PROs | CONs |

| More time for accuracy – the extra six months gives you more time to get your taxes right. It could even mean saving some money if you discover things you missed. | Penalties for paying late – even if you get an extension to file late, if you find that you’ve underpaid taxes, you’ll still be liable for penalties for late payments. |

Easy to do – filing for an extension is easy and quick to do. You can even do it online. | Other business impacts – filing late, even if you have an extension, could have you dealing with taxes while other business activities suffer, especially with seasonal businesses. |

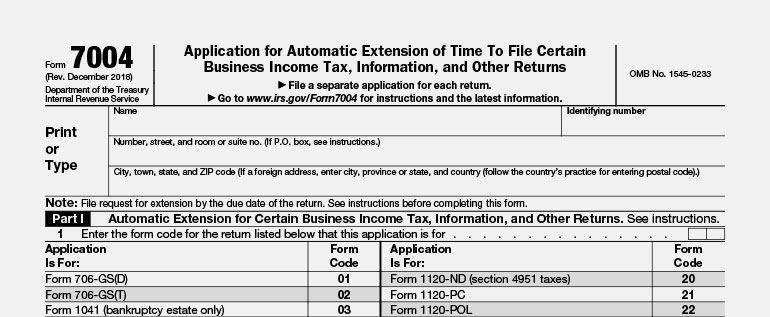

The IRS Form 7004 – Small Business Tax Extension

Instructions for Form 7004 – Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns

That’s how the IRS officially titles the form you use to file for an extension. The form instructions go on to say that they’re grant the extension if:

- The form is completed properly

- There is an accurate estimate of taxes owed (if applicable)

- You file the form by the return’s due date for which you’re requiring the extension

- You pay any tax that is due

Foreign corporations have a few due date exceptions.

Form 7004 General Instruction Notes

Here’s a list of some helpful notes to the general instructions:

- Signature – Form 7004 does not require a signature.

- Blanket requests – if you are filing more than one return and want extensions, a separate Form 7004 is required for each return.

- Extension period – you won’t receive a notice of extension approval. You will only receive a notice if your extension is not approved.

- Maximum extension period – the automatic extension period is for 6 months. There are exceptions for some C-Corporations, estates, and trusts. C-Corporations with tax years that end on June 30 can get an automatic 7-month extension.

- Extension termination – the IRS can terminate your extension by mailing you a notice stating that it is to be terminated. The notice will be mailed at least 10 days before the termination date.

- Dollar rounding – you can round off dollar amounts on the return. If you choose to do so, all amounts must be rounded off. Round amounts down that are below 50 cents. Round up amounts from 50 to 99 cents. If you are adding two amounts together, add them first and round off the total.

- Taxes due payment – Important: Form 7004 and an extension do not extend the date for payment of taxes due. Pay all taxes due by the original (not the extended) due date.

- Limit on check amount – for all of you really successful business owners, if you owe $100 million or more, you will have to break up the total over several checks.

Summary

Filing an extension to file a business tax return isn’t terribly difficult, but it’s painful if you miss an "i" or forget to cross a "t." It’s always good to talk with a tax professional to discuss whether you should file for an extension. Let them file for you and spend your time growing your income and running your business.