Contributor,

Darin Wickens

Strategic Tax Planning for Business (with Tips and Examples)

“If you fail to plan, you are planning to fail” – Benjamin Franklin. Failing to develop and implement a great strategic tax plan for business is a sure-fire way to overpay taxes. So why do so many business owners and their accountants neglect tax planning?

Here’s everything you need to uncomplicate the strategic tax planning process and the steps you can take to create a tax-optimized business strategy.

Table of Contents

- What is strategic tax planning for business?

- Importance of tax planning for your business

- The current state of tax planning and advisory

- Save taxes by being proactive—not reactive

- Is tax planning worth the extra cost?

- Tax minimization, tax evasion, and tax avoidance: the differences explained

- Common business tax planning strategies

- 7 tips to help with successful tax planning

- How Tax Hive can help

- Tax planning without the stress

“If you fail to plan, you are planning to fail” – Benjamin Franklin. Failing to develop and implement a great strategic tax plan for business is a sure-fire way to overpay taxes. So why do so many business owners and their accountants neglect tax planning?

As a business owner, you juggle many priorities. You probably have strategic initiatives to increase sales and reduce costs. But far too many overlook what likely is their most significant expense (and opportunity): Taxes.

If you’re burying your head in the sand and only thinking about taxes when you’re forced to – during “tax time” or when making quarterly payments, you’re almost certainly paying too much in taxes.

We understand taxes can be complicated and overwhelming at times. The tax code is thousands of pages long and isn’t the easiest to understand. Combining this with the reality that many taxpayers are terrified of an audit, we know the anxiety and why you might naturally avoid thinking about taxes.

Here’s everything you need to uncomplicate the strategic tax planning process and the steps you can take to create a tax-optimized business strategy.

What is strategic tax planning for business?

Strategic tax planning involves looking forward one, five, 10, or 20 years rather than looking back at the past year (which is tax preparation in a nutshell). When you plan, consider what you can do to pay the lowest tax possible while arranging some of your savings to generate a tax-free income.

Here’s an example: If you had an extra $35,000 in income every year, but that income was taxed at a combined federal and state rate of 30%, you would be left with $24,500. You could turn a loss of $10,500 into a gain through careful tax planning. You could invest that money in a laddered bond portfolio or a well-structured low-cost indexed life policy that offers tax-free distributions, for example.

Tax planning allows you to use different tax exemptions, deductions, credits, and available benefits to minimize how much tax you owe, legally and morally. That’s more money you can put towards other financial goals like advertising campaigns, capital investments, employee bonuses, or even personal financial goals like paying down a house, saving for retirement, or taking a vacation. It also gives you a snapshot of your finances and taxes at the beginning of the fiscal year instead of leaving it to the eleventh hour.

It can be helpful to think of tax planning in terms of your favorite sporting activity. In basketball, for example, you have rules, time restrictions, and referees. You also have a coach, teammates, and plays you’ve drawn up and practiced together. Waiting until the third or fourth quarter usually won’t win you the game – the preparation, planning, practice, and in-game adjustments win the game.

Importance of tax planning for your business

When you own a business, paying taxes is your obligation. However, you should never be surprised by how much you owe. Understanding how business taxes work and calculating how much you have to pay every quarter or year is essential to ensuring you have enough money or a surplus to spend elsewhere in the business.

When you invest in tax planning, you accomplish a few things. First, you lower the risk of making inaccurate tax estimates. Second, you reduce the risk of forgetting to file and pay taxes on time, leading to unnecessary fees and other penalties. And last but not least, tax planning can help you find money in tax deductions, credits, or other areas you otherwise may miss entirely.

Other benefits of tax planning include:

- Lower tax rate: It may be possible to lower your effective tax rate and reduce your tax burden using strategies that aren’t widely known.

- Reduce taxable income: Reduce the amount of income that gets taxed, with or without a change in the tax rate.

- Flexibility in paying taxes: Manage cash flow and minimize unnecessary fees and penalties by scheduling quarterly estimated taxes.

- Tax credits: Take advantage of tax credits that benefit your business and reduce your overall tax bill.

The reality is that business taxes can be complicated. Plus, tax laws often change over time and from one region to another, and many regulations apply selectively to certain scenarios and business types.

If you hire a trusted financial adviser who is well-versed in tax strategies, that person will be able to flag any most relevant updates to your business. The more legal loopholes they can find, the more you’ll be able to save, so it’s important to consider getting help here.

The current state of tax planning and advisory

With new U.S. tax legislation, as well as the impact of the pandemic on businesses, tax planning has become an essential tool to boost a business’s bottom line.

However, many tax accountants don’t currently offer tax planning as a service.

A 2021 Tax Planning and Advisory Insights survey by Intuit Accountants showed that only 1 in 3 clients currently receive tax planning and advisory services.

So, why the low numbers? If tax planning is critical to optimizing your tax situation and saving as much money as possible, why aren’t most accountants doing it? For the most part, it’s just basic economics – they have a finite amount of time and other limited resources.

And for the tax professionals who provide tax planning services, they’re billing up to five times the cost of basic tax preparation.

In addition to cost alone, tax planning requires specialized knowledge of the tax code and the ins and outs of the 1,400 plus tax deductions and credits. It’s incredibly time-consuming, with several hours spent preparing a “typical” tax plan.

But as clients become savvier about the needs of their business, the demand for tax planning is growing, and tax professionals are taking note. Many tax professionals are strongly considering adding tax advisory as a service.

Save taxes by being proactive—not reactive

Many small business owners are familiar with reactive tax planning. You monitor your sales throughout the year and keep your expenses under control, so you don’t break the bank. And at the end of the year (or quarter), you crunch these numbers to figure out how much you owe in taxes.

While reactive tax planning can help your business reduce its taxes, it isn’t the most effective method for your business. It can lead to a last-minute rush where you miss additional deductions and certain credit benefits. You also risk bringing in an advisor who isn’t familiar with your business’s financial picture over the previous year, putting the onus on you to ask the right questions.

You’ll succeed better if you ditch this method and consider proactive tax planning.

Proactive tax planning is strategic tax planning for business. It gives you more freedom throughout the year and at tax time. It’s also key to making your business more profitable and growing your in the long term. It works by looking at state and federal tax laws ahead of time and working within them, curbing your tax liability at the end of the year.

Enlisting professional advisory services (such as Tax Hive) and communicating with one of our tax pros is key to getting the most out of proactive tax planning. We work closely with you to ensure we don’t miss valuable strategies or other ways to make your business more tax-efficient.

Is tax planning worth the extra cost?

Paying an additional cost when trying to reduce your overall expenses may not be an attractive option at first glance—but it’s important to note that tax planning is an investment.

As mentioned earlier, tax planning and advisory services may cost you more than basic tax preparation. However, the result can far outweigh the initial cost. For instance, an internal study of more than 20,000 business owners by Tax Hive found that business owners are missing over $60,000 in potential business tax deductions.

Tax minimization, tax evasion, and tax avoidance: the differences explained

There are three basic strategies to lower the amount you pay Uncle Sam each year — tax minimization, tax avoidance, and tax evasion. Two are entirely legal, but practicing one of them could land you behind bars.

Tax minimization

Tax minimization is 100% legal. You use the most tax-efficient methods to get long-term benefits for you and your business. It involves income shifting, entity structuring, tax deductions and credits, writing off appropriate expenses, or taking advantage of benefits through health insurance and retirement plans. It’s a way to optimize your business—before tax season starts.

Tax evasion

If you’ve watched legal dramas or gangster films, there’s a good chance you’ve heard of the term “tax evasion.” Tax evasion is an illegal practice where taxpayers don’t accurately report their total income earned to avoid paying higher taxes. Evasion could include underreporting sales, claiming inflated or unwarranted deductions, forging documents, and transferring illegal assets. A form of tax fraud, tax evasion is a serious crime that can lead to hefty fines and even jail time.

Tax avoidance

While tax evasion is against the law, tax avoidance is a way to reduce your tax liability legally. Avoidance could include decreasing business expenses, maximizing tax credits, taking advantage of loopholes, or deferring the payment of taxes with a pre-determined plan. It’s important to note any tactics used to avoid taxes must fall within the framework of the law. That said, it’s a good idea to seek the advice of a tax expert or attorney to ensure you haven’t crossed over into tax evasion territory.

Common business tax planning strategies

1. Business entity structure

Each business entity and structure has its tax benefits and drawbacks.

Let’s look at sole proprietorship, for example. It’s the most common type of business in the U.S., representing 73 percent of all businesses. While sole proprietorships are easy to start and inexpensive to operate, they’re generally not the best business structure for many things, like limiting personal liability or reducing taxes.

Sole proprietorships generally aren’t great for reducing taxes because your business and personal income aren’t taxed as separate entities. Instead, they’re considered “pass-through” entities. This means your business income and expenses are passed onto you, the business owner, and recorded on your individual income tax return. So, your business ends up contributing to higher overall income, potentially raising your all-in tax rate for both personal and business, depending on your income bracket.

Incorporating can potentially reduce your tax liability. For one reason, the Tax Cuts and Jobs Act lowered the corporate tax rate to 21% in 2017. You can also save on self-employment taxes with the proper tax filing election (e.g., S-Corporation election). But that doesn’t mean it’s the best move for everyone.

The cost of incorporation can get pricey and comes with strict reporting requirements, which can add a pile of paperwork to your to-do list.

Whether a C corporation, partnership, or limited liability company (LLC), switching to another entity type can significantly impact how much you might pay (or save) in taxes. Talking through your options with a tax professional—or your in-house Tax Hive advisor—can help you evaluate your choices and what structure might best suit your tax needs. It’s valuable to consider your tax filing status before you set up a formal business entity.

2. Tax filing status

Your filing status determines your filing requirements, standard deduction, eligibility for certain credits, and your correct tax. If more than one filing status applies to you, the IRS has an online questionnaire you can do to help you choose the one that’ll get you the lowest amount of tax.

The type of business and how you structure your business largely determine the tax return you need to file. If your business is a sole proprietorship, you report your business income on the Schedule C (Form 1040) income tax form. For a partnership, report your expenses, losses, and income on Form 1065.

If you own a single-member LLC, the IRS treats you as a sole proprietor, so you’ll use Form 1040, Schedule C, E, or F. If the only member of the LLC is a corporation, report the LLC income plus expenses on the corporation’s return on Form 1120.

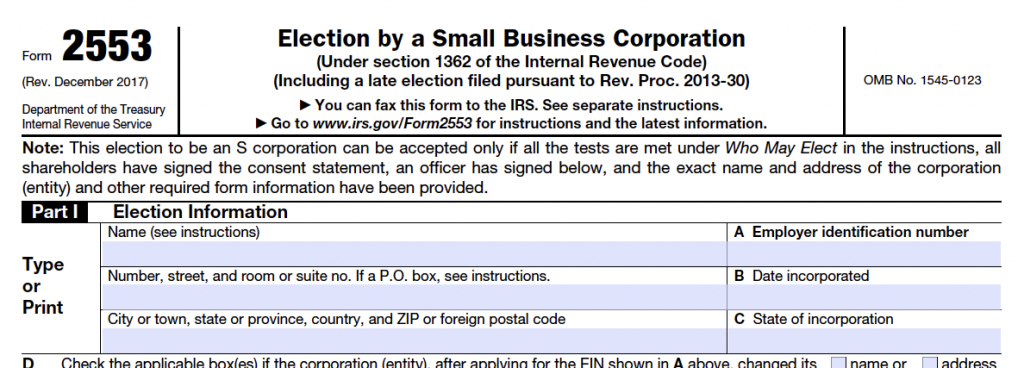

Depending on your business structure, you may qualify to file your corporate taxes as an S Corporation (also known as S-Corp or S Corp). An S Corporation is not a business structure. Instead, an S Corp is a tax filing status that allows your business to pass corporate income and expenses to shareholders for tax purposes.

Operating a corporation and LLC but filing taxes as an S Corporation can bypass double taxation and significantly reduce your self-employment taxes. You should work closely with a tax professional, accountant, or attorney to evaluate eligibility, deadlines, and requirements. You can read more about Form 2553 from the IRS. When you file taxes as an S Corporation, you’ll use Form 1120-S.

3. Asset location

Organizing your assets through asset location is key to dramatically reducing taxes in your portfolio and enhancing the tax efficiency of your investments.

Asset location focuses on where to strategically invest your money to maximize your return on investment after-tax rather than how to invest. Don’t confuse it with asset allocation, which is how you mix and distribute your assets within a given account.

Generally, you’ve got three types of accounts for investing and saving, each with different tax treatments: tax-advantaged, tax-free, or taxable accounts.

- A tax-advantaged account is a kind of savings plan or financial account where you get a tax benefit such as tax deferral or tax exemption. This account is famous for retirement savings, education expense savings, and savings for healthcare expenses. Investment examples within a tax-advantaged account include stocks, actively managed funds, mutual funds, high-yield bonds, REITs, and annuities.

- A tax-free account lets you save with after-tax dollars. You don’t escape taxation entirely since you’re using the money you’ve already paid taxes on. But when you make qualified withdrawals, you pay no additional income tax–not even on your investment growth. Some tax-free accounts include Roth IRAs, Roth 401(k)s, and Roth 403(b)s.

- With a taxable account, there’s a downside: You don’t get a tax deduction for the money you put in, unlike a 401(k) or a traditional IRA. And you don’t get to duck paying taxes when you take cash out like you can with a Roth. Instead, you must pay capital gains tax on the earnings from your investments when you sell them. On the upside, a taxable account doesn’t put a ceiling on your contribution amounts like tax-deferred and tax-free accounts do.

When allocating your growth assets (like stocks) across the different account types, you should consider these factors:

- The tax efficiency of assets (What kind of gains do they make? Long-term, short-term, or ordinary?)

- The management style of assets (Do you manage assets passively or actively?)

- Client profile (age, time horizon, tax bracket, taxable income level, liquidity needs, and estate planning needs)

4. Tax-loss harvesting

It’s bad news when you lose money on your investments, right? Watching your portfolio shrink in a bear market can be downright painful. But a reasonably simple tax-loss harvesting strategy can help turn that pain into a tax advantage.

Tax-loss harvesting (also called tax-loss selling) happens when you sell an investment that has dropped in value below what you paid, triggering a capital loss.

You then use the proceeds of the sale to buy a comparable investment (in the same sector, for instance) while the market is still down, hoping it will increase in value over time and deliver a capital gain.

You then apply your capital loss to your capital gain, and presto! Tax savings.

Why not sit on your original investment until the price recovers and even jumps above your purchase price? Because you’d still have a capital gain, but you wouldn’t have a capital loss to offset it.

And if you sold low but didn’t jump back into the market, you’d miss the chance to squeeze some value from your capital loss. Because you don’t pay tax on capital gains inside registered accounts, tax-loss harvesting only works for taxable, non-registered investment accounts.

5. Income shifting

Income shifting is moving unearned income from someone in a higher tax bracket to someone in a lower tax bracket. It aims to save tax by moving investment or business income off your tax bill to a retired parent or child, for example.

You can do this in a few ways. One is to hire, say, your 18-year-old son, to work at your business. You get a business deduction for their wages, and your son pays less tax on that money than you would have. If you have a sole proprietorship or partnership and hire a child under 18 to work for you, your child doesn’t have to pay Social Security or Medicare taxes.

It’s a bonus that you’re already supporting your child, so why not get a tax break? You may not control what your child spends their wages on, but you can agree that a share of it can go towards an investment like their college fund.

The IRS knows people will go to tremendous lengths to outwit them, so they’ve put a lot of rules and limits on income shifting. If you hire your child, it has to be a real job, paid at the going rate, and you should have proof of the work.

There are also rules about what kinds of assets you can transfer, how old a child must be to accept the transfer, and a ceiling on the amount transferred before it triggers the gift tax. Talk to your accountant to ensure you’re doing it by the book.

6. Capital gains harvesting

Capital gains harvesting is strategically selling your winning investments to reduce current and future taxes and create a more balanced portfolio. How does it work? Capital-gain harvesting offers investors the chance to achieve long-term capital gains with little or no impact on their taxes. It can work in three ways:

- If you have a fluctuating income (you’re self-employed, work part-time, or on sabbatical) and know it’s going to be a lean year, it’s an excellent time to sell your high-performing assets, realize your gains and pay lower tax on them than you would in a high-income year.

- If you have losses elsewhere in your portfolio, you can use them to cancel out any tax you might owe on your gains.

- If a particular class of assets is performing very well for you, its value in proportion to your entire portfolio won’t line up with the asset mix you want to maintain. So, selling some high-performing assets and using that money to buy lower-performing assets “on-sale” will let you put your portfolio back into balance.

But we know the IRS doesn’t make it too easy to avoid paying taxes. They’ve created some rules about capital gains harvesting, too. For instance, you must own an asset for at least a year to qualify for the tax rate for long-term capital gains (which is lower than the regular capital gains tax rate).

And selling your assets may put you on the hook for net investment income tax or alternative minimum tax. Again, your accountant or financial advisor can help you avoid these pitfalls.

7. Charitable giving

Whether you’re sponsoring your local Little League team, creating an endowment at your alma mater, or doing something in between, your charitable giving can benefit your small business’s bottom line and your community.

Like all the tax breaks we’ve discussed, there are limits on how much money you can donate during any given tax year. As an individual, you can donate and write off up to 100% of your taxable income, while your business can donate and write off up to 25% of its taxable income.

If you take the standard deduction (as most people do), you may not see an additional tax benefit for your giving. Don’t let this stop you from making a charitable donation.

Here’s one way to give strategically to maximize your deduction: Instead of making donations below the standard deduction for several years, cluster them in one year. That way, the total you give exceeds the standard deduction, and you get a better tax break. Depending on how much you donate, you can do this by giving every other year or even every third year.

Another popular way to make the most of your charitable donations is a donor-advised fund. Donor-advised funds let you make charitable contributions and get your tax deduction immediately. You can put several years’ worth of donations into the fund, take the full deduction for that year, and then decide how, where, and when to hand out your money in the following years.

7 tips to help with successful tax planning

As you get started with tax planning, here are seven things you can do to streamline the process.

1. Get organized

It can be easy to throw away receipts or forget to keep track of smaller expenses, but for tax purposes, it’s best to keep as many records as possible. Any tax-planning advisor will ask you for details and records of all your accounts. But even if you’re not working with one, it’s your responsibility to keep track of all financial aspects of your business. By doing so, you can customize tax strategies to their needs.

2. Understand your tax obligations

A basic understanding of federal, state, and local tax regulations can help you avoid paying too much in taxes and protect you from the risk of paying too little. Also, with some knowledge of tax-related topics, you’ll be able to identify potential tax benefits (and tax traps) in time to do something about them. Even if you believe no taxes are due, you’re still responsible for filing the return.

The IRS provides a list of due dates and directions for filing your taxes. That said, we strongly recommend hiring an accountant to set up your tax filings and payment schedule. Missing a due date, not paying the taxes owed, or not filing at all could raise flags with the IRS. You could face potential IRS scrutiny, fines, tax penalties, and interest.

3. Know your deductions and credits

The answer to having the lowest tax bill is not leaving a single tax credit or deduction on the table. Both reduce your tax bill, but in separate ways. Knowing the difference allows you to work out some very effective tax strategies.

A tax deduction reduces your taxable income and is taxed at a certain percentage based on your bracket. Basically, only a specific rate of every dollar you deduct gets taken off your income tax.

For example, if your tax rate is 10%, one dollar of deductions will give you 10 cents of tax savings. With a 24% tax rate, one dollar will save you 24 cents.

Operating expenses are a good example of tax deductions as they allow you to deduct any reasonable expense you incur to earn income, including any tax paid on that expense. This includes things like bad debts, business insurance, education, marketing costs, work-related travel expenses, and office supplies.

A tax credit, on the other hand, decreases your taxes directly by reducing the income tax you owe dollar for dollar. A few credits are refundable, which means if you owe $250 in taxes but qualify for a $1,000 credit, you’ll get a refund for the remainder of $750. (Most tax credits, though, aren’t refundable.)

There are hundreds of credits and deductions out there. Here’s a list of common ones that will help you get a larger tax return.

Further reading: Self Employed Tax Deduction Cheat Sheet

4. Choose the best strategic tax and accounting method: cash or accrual

Which strategic and accounting method should you use? It depends on the timing of when you reflect sales and purchases in your books.

Cash accounting identifies expenses and revenue only when cash changes hands. It’s used mainly by small businesses and sole proprietors with no inventory.

Accrual accounting reports revenue when a business earns money (e.g., when a project is complete) and expenses when billed (e.g., when you receive an invoice) but not yet paid. According to the IRS, corporations (other than an S corp) with gross receipts averaging over $25 million for the last three years must use the accrual method.

Your choice will make a difference in how your company schedules tax payments.

With the cash method, taxes are not paid on money you haven’t yet received. With the accrual method, taxes are paid on money that you’re still owed.

5. Use tax planning software

With technology continuously evolving, it’s now easier than ever to file your taxes using the software. Tax software allows you to prepare your taxes quickly and efficiently, making tax refunds you deserve easier to get.

As a small business owner, you know how crucial accurate record-keeping is for your company’s success. Platforms like Holistiplan, Tax Planner Pro, and TaxWise can save you time, maintain precise bookkeeping records, reduce errors, and automatically create reports that’ll help you understand your business finances and help you complete your taxes in less time. You can file documents in one place and organize your records year-round with just a few clicks.

You can also plan out how much tax is due, determine what deductions you can claim for your business, and see where you must comply with government regulations and rules. Not being organized could leave you paying far more taxes than you need to.

6. Stay up-to-date with tax law changes

With the U.S. tax law constantly changing (even more so since the pandemic), keeping up with the latest IRS rules and regulations can be a superhuman feat.

Having a tax plan helps you understand what’s changed and lets you reassess your strategy when needed. By understanding current tax laws, you won’t risk noncompliance with new or updated regulations, and your tax return will contain fewer errors. You’re then less likely to face an audit or have to pay more money down the line.

Here are some significant tax changes for the 2022 tax year.

Working with an accountant can ensure you comply with current regulations and pay the right amount.

7. Work with a tax planning professional

There’s nothing fun about paying taxes, so coughing up high fees to handle your taxes can exacerbate an otherwise unpleasant situation. On the other hand, preparing your tax return can be risky. It can cost you thousands of dollars in overpaid taxes, fines, and penalties because of overlooked deductions and simple mistakes.

For that reason, many small business owners hire a CPA, accountant, tax attorney, or a specialized tax professional with a proactive approach to tax planning to take care of their taxes and provide other accounting and business advice. As we discussed above, many CPAs, accountants, and tax preparers don’t provide proactive, comprehensive tax planning.

Tax planning services may cost more initially, but they can help your small business grow by providing advice on short-term and long-term tax-saving opportunities.

How Tax Hive can help

If you’re still in the process of hiring an accountant, bookkeeper, and tax advisor for your small business but need help with your tax-saving plan today, Tax Hive will pair you with an experienced accountant to help evaluate your needs and execute an optimized tax plan. Our tax-slashing technology and tax experts look at over 1,400 federal, state, and local deductions as they review your unique situation.

Even after building your plan, Tax Hive professionals are always available to answer questions, address concerns, and make appropriate adjustments. They’ll also ensure you’re ready come tax time with a year-end financial plan, including all the information you need to file—our tax team can even file your taxes for you.

Do you have a CPA, accountant, or tax prep firm you already like? No problem. Simply take our plan to them to implement on your behalf.

Tax planning without the stress

A well-implemented strategy allows you to execute a tax plan tailored to your business and its needs. Tax season and financial planning are much more effective and less stressful when you have a solid plan. Doing so is a step in getting ahead of your competitors, allocating more money towards business growth, and ultimately lowering your taxes.