Business Asset Protection Keys

One of the great tragedies in creating and growing a business is to lose your assets, or the business due to overlooking or failing to properly protect the business. Most of the key principles for protection of your business assets are commonly talked about and are familiar to business owners or their accountants.

So, failure to implement these protections is often more of an avoidance due to costs or effort to take the right steps. In this article, we will provide a short checklist of these key principles, and the failure to abide by them.

- Failure to establish the right entity. There are multiple types of entities, and we have discussed them in other articles. For most startup businesses, the choice would be a Limited Liability Company (LLC). This is a relatively simple type of entity, but it still provides separation between business and personal assets and numerous tax deductions to save money on your income tax. Although you may find it challenging to decide what type of entity to form, most tax accountants and attorneys will tell you that the biggest mistake business owners make is not the choice between entity types, but rather the choice to act and implement an entity. They will commonly tell you that the worst decision you can make is to fail to or delay forming an entity. Form the entity as soon as you possibly can to obtain the protections that they provide.

- Not using the entity properly to establish the corporate veil. The corporate veil is a separation between company and private assets. It begins with the establishment of an entity, but must include separation of funds, transactions, and company actions performed by a company officer. Failure to properly create this separation will make it difficult or impossible to protect yourself from lawsuits that include the personal assets of the company owner as well as the business assets.

- Place some assets in the name of your spouse. This is a delicate situation to deal with but creating a separate ownership of certain assets under the name of a spouse separates those assets from the liabilities of the other spouse. If one spouse is a business owner, and there is a risk of lawsuit to the business, it may be a wise strategy to put other personal assets under the spouse’s name. But bear in mind, that if the future should bring a divorce, those personal assets would be awarded to the person whose name is on title. Plan your strategy carefully.

- Use proper agreements and contracts and put it in writing. Whether this includes arrangements with partners, or leases, contractor agreements, etc., all arrangements involving the company should be documented and placed in the company name. A good solid written agreement that clearly indicates the parties, the terms of the agreement, and is properly signed and dated is a huge element of avoiding confusion, and keeping assets separated.

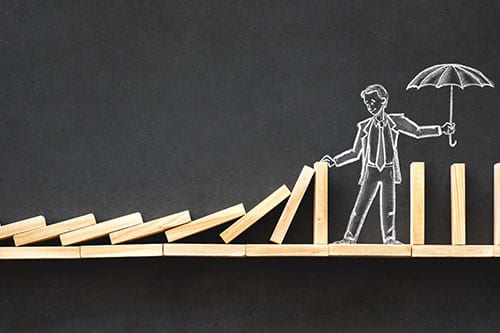

- Obtain proper insurances for both your company and personal protections. Whether your business owns real estate assets, such as rentals, or a professional practice or a wholesale or retail enterprise, these assets should be properly insured. The important consideration is that this gives other people a different target if they have a perceived damage. Instead of filing a lawsuit, they can file a claim against insurance. An additional type of insurance policy would be an umbrella policy. These can be obtained by a company or by an individual and provide additional coverage above the limits of any other insurance policy. Please keep in mind that no insurance policy will insure you if you break the law, they are intended for legitimate liability protection only.

- Use Homestead Exemption if available. In many states, a personal residence is entitled to a Homestead Exemption. This exemption allows for a lower rate of taxation than non-exempted properties, but also has the added advantage of protecting a portion of the value of the property from loss to bankruptcy or creditors.

We have included the items above as examples of protecting your business assets. These are easily definable actions that should be performed by company owners. There are other actions that are a little less clearly defined. Working with partners requires that there be clear agreements to prevent lawsuits. Taking actions as an officer of a company requires that the company provide you with the authorization to do so. An example of this would be writing a check. If the company does not authorize you to write a check, or requires two signatures, or places a limit on the amount that you can write the check for, then failure to abide by these authorizations can create major issues, and sometimes could involve breaking laws. Major actions as a business owner should be clearly thought through, and placed in writing, and signed by all partners to provide the necessary authorizations.

Running a successful business not only involves having valuable and saleable products and services, but also working within the law, and in harmony with business partners, spouses, and the world at large.

__________________________________________________________