Hire Experts for Corporate Tax Returns (IRS Form 1120)

Running a corporation is a complex venture, and the corporate tax return bears that out. While the Form 1120 is six pages long, the instructionsi are 30 pages of small print. There are many good reasons for forming a business as a corporation that make the complexity worth the effort and expense.

- Liability protection – a properly formed corporation protects the owners/shareholders from liability for the actions and financial obligations of the corporation.

- Unlimited life – owner shareholders eventually die, but a corporate entity lives on forever. The share equity of the owners is passed along to heirs or sold, but the corporation remains in business.

- Easy ownership transfer – generally, the ownership of a corporation can be transferred easily, though there are some restrictions on transfer of S-Corporation ownership.

- Tax advantages – premiums paid for owner-employee insurance and qualified contributions to retirement plans are deductible. Corporate income is not subject to self-employment taxes, social security, or Medicare premiums. There are other tax advantages, but consult a tax professional for advice.

- Raising capital – raising capital is easier, as usually all that is required is the sale of stock.

It is easy to see why owners may want to form a business as a corporation, but it does make things more complicated. Here are some of the highlight sections of the IRS Form 1120 Corporate Tax Return Instructions:

- Who must file – From IRS.gov: Unless exempt under section 501, all domestic corporations (including corporations in bankruptcy) must file an income tax return whether or not they have taxable income. Associations electing to file as corporations for tax purposes must file.

- When and where to file – In most situations, a corporation must file its income tax return by the 15th day of the 4th month after the end of its tax year. A new corporation filing a short-period return must generally file by the 15th day of the 4th month after the short period ends. Corporations that have dissolved must generally file by the 15th day of the 4th month after the date they dissolved.

- Accounting methods – taxable income taxes should be calculated using the methods of accounting regularly used by the corporation in keeping its books and records. Methods used must clearly show the taxable income, including cash, accruals, or other methods authorized by the IRS. There are detailed rules and exceptions in this section.

- Other forms or statements that may be required – There is a list of other forms and statements, each of them explained, in this section. In general, these forms and statements validate specific income or expense items.

- Line-by-line Form 1120 Instructions – There are line item instructions for 37 lines in the base form, as well as line-by-line instructions for Schedule C, Schedule J, Schedule K, Schedule L, and Schedule M.

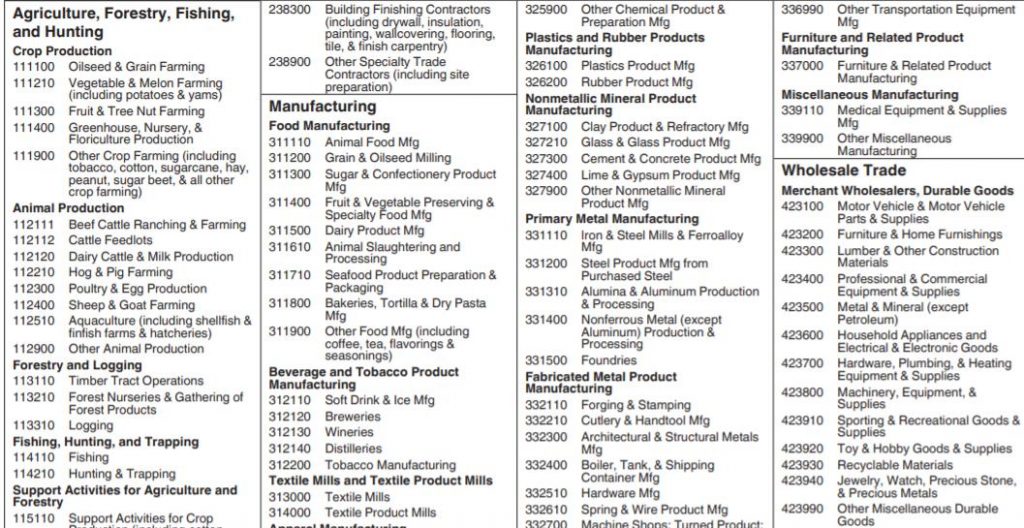

- Your Principal Business Activity Code – there is a detailed listing of business types with codes the IRS uses in their classification. You should find your business in one of the major industry categories. Here is an example of that code section:

There is a lot of highly detailed information in these instructions, and you should access the services of a tax professional in interpretation and corporate tax return preparation.

i IRS Form 1120 Instructions – IRS.gov