Tax Hive Blog

Enjoy these timely and informative articles that can help you make informed decisions about your business.

6 Things You Should Have for Effective Estate Planning

Estate planning is not just about protecting your assets and who gets them when they die. Everyone over their lifetime will acquire assets s …

Read More

SEC Info About Self-Directed IRAs and the Risk of Fraud

The SEC’s Office of Investor Education and Advocacy has issued an Investor Alert about the risk of fraud in self-directed IRAsi. Because the …

Read More

The Importance of Custodian Choice for Self-Directed Accounts

The self-directed IRA and 401(k) retirement accounts place extra duties on the custodial firm, extensive duties in the case of assets like r …

Read More

Tax Depreciation Tips

Depreciation on taxes is kind of a tax deduction schedule for big ticket items. You may already be well familiar, but in case you are not, l …

Read More

Buying Real Estate in an IRA or 401(k)

Before discussing real estate in a retirement account, why even consider real estate as a retirement investment? A quick run-through of the …

Read More

The Tax-Saving Trust as Easy as AB…

Marriage involves a financial partnership as well as an emotional commitment. Over time, a married couple can accumulate significant joint a …

Read More

Tax Savings with a Charitable Remainder Trust

The charitable remainder trust is a vehicle for exercising your charitable nature and enjoying tax advantages as well. It is only viable at …

Read More

Revocable or Irrevocable – Which Trust Type is Best for You?

Trusts are valuable to many as estate planning tools and for tax advantaged treatment and protection of assets. The two basic types of trust …

Read More

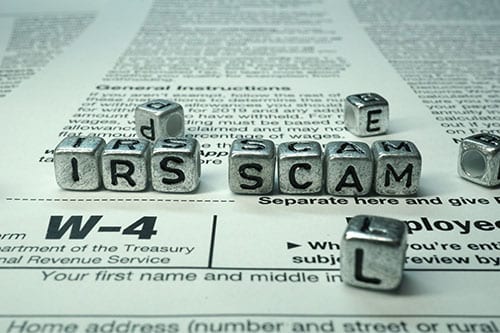

Top 3 Abusive Tax Shelter Schemes-Avoid the IRS “Dirty Dozen”

The IRS has a “Dirty Dozen List” of tax evasion schemesi, and you do not want to get caught in one of them. It is rarely a conscious wish to …

Read More

No Posts Found

Schedule a FREE Ask a Pro Consultation

On the call, we'll guide you through a self-assessment designed by tax advisors to help you identify potential business tax savings (*Ask about our guarantee).

START NOW