Contributor,

Chris Bartold

Tax Guide for Rideshare Drivers

As a part of the gig economy, ride sharing has become a major self-employment opportunity for many. Estimates vary as to how many Uber and Lyft drivers are in the U.S., with some being as high as 2 million. If you’re one of them or planning to become a rideshare driver, use this tax guide for rideshare drivers to help you get your tax ducks in a row.

Unless you reside in California, the IRS considers rideshare drivers as self-employed, which means that the IRS considers you a business and will tax you that way. The IRS publication Manage Taxes for Your Gig Work gives the basics of gig work taxes. Better than the IRS-speak, get those basics here to stay out of trouble and avoid penalties and interest from tax mistakes. If you’re delivering food or groceries for Instacart or similar companies, much of this information applies to you as well.

You Pay Two Types of Taxes

You’re in business as a self-employed rideshare driver. You have no employer to withhold taxes. You’re likely responsible for quarterly estimated tax payments for two tax types.

Income Taxes – Rideshare Business

As an employee you’d normally completed the IRS Form W-4 to provide your employer information to withhold the proper amount of taxes during the year. Many people want to avoid a nasty surprise at the end of the year. They may understate their dependents to make sure that their employer is withholding more than enough in taxes. This way they get that nice tax refund. That’s all over when you’re self-employed.

Self-employment Taxes – Rideshare Business

As an employee you didn’t have to think about Social Security and Medicare taxes. Your employer took care of getting the right amount withheld from your pay and getting it to the IRS. Even better for you, your employer paid half of these taxes, only holding out half from your pay. That’s all over now too. You are responsible for the entire amount.

For 2022, the self-employment tax rate is 15.3%, which consists of 12.4% for Social Security, and 2.9% for Medicare. The good news is that you won’t have to pay this on your entire income from driving. You have deductions (discussed later) for operating your business. You pay income taxes and self-employment taxes on your net income after your deductions.

Quarterly Estimated Tax Payments

You’re now the “employer” when it comes to getting money to the IRS when due. This means that the IRS generally wants paid tax in quarterly payments. If you expect to owe more than $1,000 in taxes for the year, you must pay quarterly estimated payments.

That $1,000 bottom limit comes up quickly because it includes the income taxes and the self-employment taxes. Again, you calculate taxes on your net income (profit) after your tax deductions (discussed later). You should make a habit to open a separate bank account (ideally a savings account) just for taxes. Any business income you receive, put a portion of that into the separate bank account to ensure you have the money to send the IRS when you need it.

What portion or percentage should you set aside for taxes? Your first year is the most difficult, because you don’t yet know the approximate amount of deductions and your approximate net profit percentage. But, if you keep up with your deductible expenses the first quarter, deduct them from your rideshare income, this will leave your profit/net income for that quarter.

If your deductions are running 30% of income, you could assume that your profit for taxes is 70% of income -- use that number until you build more data over time. For example, if you took in $3,000 for the quarter and 70% of that is profit, you would estimate owing taxes on $2,100 ($3,000 x .70 = $2,100). Your deductions could be higher or lower. Remember that now you owe income taxes and self-employment taxes.

Now, what portion should in tax should you plan to pay on net income for quarterly payments? HostAgencyReviews.com’s article titled The Beginner’s Guide to Navigating & Paying Estimated Taxes in 2022 says this: “You could very well owe 25% of your earnings or even upwards of 40% depending on your income bracket and state tax levels.” So, in the example above, where you received $3,000 in income, you set aside 70% or $2,100. If you’re in the 25% tax bracket, you’d owe $525 ($2,100 x .25 = $525).

**Happy Note: You’re now the employer, so you get to deduct half of the self-employment tax amount. You’ll see that in the deductions discussion later.

If you’re still employed, working parttime ridesharing, and do not expect to make that much, you can have your employer hold out extra from your wages/salary and avoid the quarterlies altogether.

Quarterly Estimated Tax Due Dates

| Income for: | Quarterly Estimated Due Date |

| January 1 through March 31 | April 15 |

| April 1 through May 31 | June 15 |

| June 1 through August 31 | September 15 |

| September 1 through December 31 | January 15 of following year |

After your first year, the IRS requires you to pay quarterly estimated payments totaling 100% of the previous year or 90% of the current year to avoid penalties. So, if you’re putting back enough in that tax savings account, meeting one of these minimums will mean you won’t be penalized. You’ll still owe the difference if you’re underpaid, so keep depositing taxes to savings.

How to Pay Quarterly Estimated Payments

The IRS recommends paying online rather than by mail, but either method is acceptable. It’s free to pay online with a bank account. If you want to pay by credit card, you’ll be charged processing fees. Also, some bookkeeping software, such as Quickbooks, is integrated and will help do some math for you and allow you to pay your quarterly tax payments directly within the bookkeeping software. If you want to mail in your payments, don’t use the address on your other tax return forms. If you want to pay by check or money order, review IRS publication Pay by Check or Money Order.

Tax Deductions for Rideshare Drivers

The tax stuff gets less scary (Side note: the fear of taxes and the IRS is a real thing - it’s called forosophobia) after you see the legal deductions you can take to reduce your gross income and get to your taxable income.

Before digging into the details, here are some tips to make it easier and help you to keep accurate records for tax filings:

- Have a system – you can use a spreadsheet, database, bookkeeping software, or an app. Be consistent and save every document from purchases to be sure you do not miss legal deductions. Credit card statements aren’t sufficient documentation for expenses – you need to keep the actual receipts.

- Bank and credit card accounts – have separate bank and credit card accounts for the business to keep a clean separation between personal and business expenses.

- Vehicle and mileage – be especially careful in this area because it is going to be a large chunk of your expense deduction total. The IRS requires a mileage log with details of trips. Learn more here. There are also mileage tracking apps that can automate much of the entry process.

- Review Uber & Lyft documents – you’ll get reports of income from Uber and Lyft. They will also break out different types of income, as you may get bonuses or other incentive payments in addition to trip income.

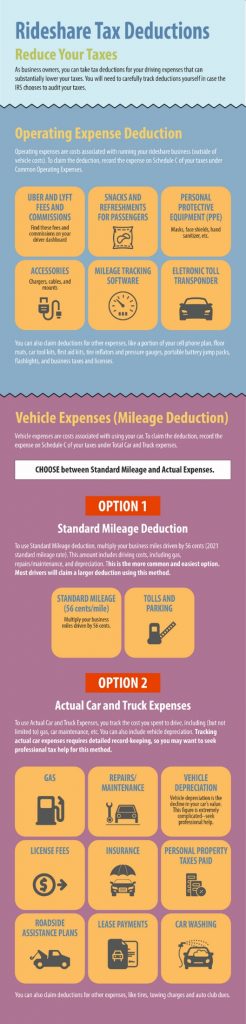

Vehicle Expense Deductions

There are two ways to report and deduct expenses for the use of your vehicle in your business. Both require a detailed mileage log. This is especially necessary if you use your vehicle for both business and personal, as most rideshare drivers do.

- Standard Mileage – the easiest way to report and take the vehicle expense deduction is to use the standard mileage rate. For 2022, the IRS has set the rate per mile for business use at $0.585/mile. This is a one-deduction-fits-all solution. You do not take any other deductions for fuel, repairs, etc.

- Actual Expenses – use the actual expenses method if you expect to exceed the standard mileage deduction by enough to make the record-keeping work worthwhile. You track all your expenses, fuel, repairs, insurance, depreciation, and any other vehicle related costs. You take a percentage of the total based on your percentage of business use.

Operating Expense Deduction

All other business expenses fall into this bucket. They can include:

- Uber and Lyft fees or other charges

- Vehicle accessories added for the business

- Floor mats

- Tire inflators

- Pressure gages

- Tool kits

- Charges for a toll responder

- Software or software subscriptions for bookkeeping and mileage tracking

- Any personal protective equipment

- Amenities for passengers

- Portion of your cell phone bill for business

- Tax related services

- Business licenses and taxes

It’s critical that you keep receipts, either on paper or digitally, for every deductible expense. As the gig economy grows, the IRS is hiring more people to scrutinize gig workers’ tax returns.

Should You Do Your Taxes?

Rideshare drivers, especially those doing it fulltime, will have enough on their plate to just keep up with receipts and all income and expense documents. When it comes to tax return preparation and things like depreciation, you could save money by using professionals.

Even if you just use a professional to do your tax preparation and filing, you could avoid IRS problems due to error avoidance. Having someone else checking your data can help as well. The IRS looks closely at returns with deductions that are out of line with income. A professional tax preparer can help you to reduce the unpleasant audit situation.