April 18, 2022: “WASHINGTON (AP) — The Supreme Court on Monday rejected a challenge from New York, New Jersey, Connecticut and Maryland to the 2017 tax law that capped federal tax deductions for state and local taxes. The lawsuit had previously been dismissed by lower courts. It argued that the Republican-led tax law, signed by then-President Donald Trump, unfairly singled out high-tax states in which Democrats predominate.”

Category: News

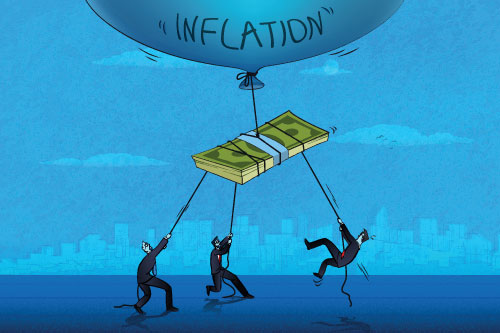

Tax Season Adds Pressure to Small Businesses Already Stung by Inflation & Labor Shortages

Mon, April 18, 2022: “Running a small business has never been easy, but this year the stress has been ratcheted up to levels not seen since the Great Recession. The combination of COVID-19, high inflation and labor shortages — along with the usual stresses of tax season — have left many small business owners worried about how they will survive, according to a couple of recent surveys.”

Biden’s Labor Department Has Big Worries About Crypto In 401(k)s

The U.S. Department of Labor came out this week with an unusually strong warning about cryptocurrencies pushing their way into 401(k) retirement accounts. Over the last few months, some financial institutions have started marketing crypto investments as potential options in these highly regulated accounts, and that’s a problem according to the DOL.

The congressional spending bill battle had a not-so-great message for small businesses

Most small business owners on Main Street say they support more financial relief from the federal government, but the resolution of the battle in Congress last week over the spending bill for the federal government shows that it may not be coming.

Cash-rich states create ‘competitive environment’ with flurry of tax cuts

There’s been a wave of state tax cuts spurred by budget surpluses, and more breaks may be on the way, according to policy experts. Some 29 states and the District of Columbia enacted “significant” reductions in 2021, according to the Tax Policy Center.

25% of Main Street Businesses Plan to Add BNPL in Next 12 Months

The survey found that 54% of the respondents expect inflation to be a challenge in 2022, and 50% say the same of uncertainty about economic conditions. Smaller shares of the business owners are worried about increasing competition from larger businesses (31%), an inability to purchase from suppliers (29%), costs associated with employees (28%) and an inability to hire good employees (27%).

Why AI is a small business’s best friend

Artificial intelligence is rapidly making its way into the small-and-medium business (SMB) layer of the economy, with the same promises and pitfalls that it has brought to large organizations. Both on the cloud and in the traditional data center, new services and software releases are bringing advanced AI tools to the less-than-mighty in low-cost, easy-to-use formats that don’t require rare and expensive skill sets to operate.

Warren Buffett quietly boosted his Japan bets, warned about Fed rate hikes, and defended his tax contributions. Here are 12 key insights from his annual letter.

Warren Buffett’s latest letter to Berkshire Hathaway shareholders contained plenty of nuggets for close followers of the investor and his company. Buffett blamed the stock-market boom for a surge in deceptive accounting, and assured investors that Berkshire would deal with higher interest rates and do its part to combat climate change.

Did you start your own business in 2021? Here’s what you need to know before filing your taxes

In 2021, amid the ongoing pandemic and “Great Resignation,” Americans filed a record 5.4 million applications for new businesses, according to data from the U.S. Census Bureau. That means a lot of new business owners are facing their first filing season. While many people can file their personal returns on their own, tax experts strongly advise that business owners seek professional help.

Focusing on Your Perfect Business Plan Actually Holds You Back

I’m lucky to have read some outstanding business plans. They were well researched. They presented an innovative look at the market. They provided examples of how others have succeeded from working within that same market. But there never seemed to be a correlation between the business plan and future success. After a while, I stopped worrying so much about their business plan.