Simple, straightforward customized pricing for the tax savings your business needs

Your business is unique, and so is your tax strategy. We tailor services to maximize your savings starting at $399. Book a strategy call to build your custom tax plan.

Built to save business owners money

Keep more money in your business, GUARANTEED*

- Double Your Investment or Your Money Back!†If we don’t find you double your investment, you get every penny back-guaranteed.

- Reasonable Service PlansWith comprehensive support you’ll never have to worry about an hourly fee.

- All-Year Tax SupportWith a forward-taxation plan and all-year support from your team, you stay focused on building your business.

"Smart business owners know that tax planning isn’t optional—it’s how you keep more of your hard-earned money. If you wait until tax season, you’re already losing. Get ahead, make a plan, and maximize your savings."

— Kevin O'Leary

Frequently asked questions

Why hasn’t my current accountant created a business tax savings plan for me?

We can’t speak for your accountant, but we find that many accountants are not qualified to create a comprehensive plan, they lack the time or staff to accomplish all that is necessary to take full advantage of a comprehensive plan or they are simply unaware they are not optimizing their clients’ businesses for tax savings (maybe ask them).

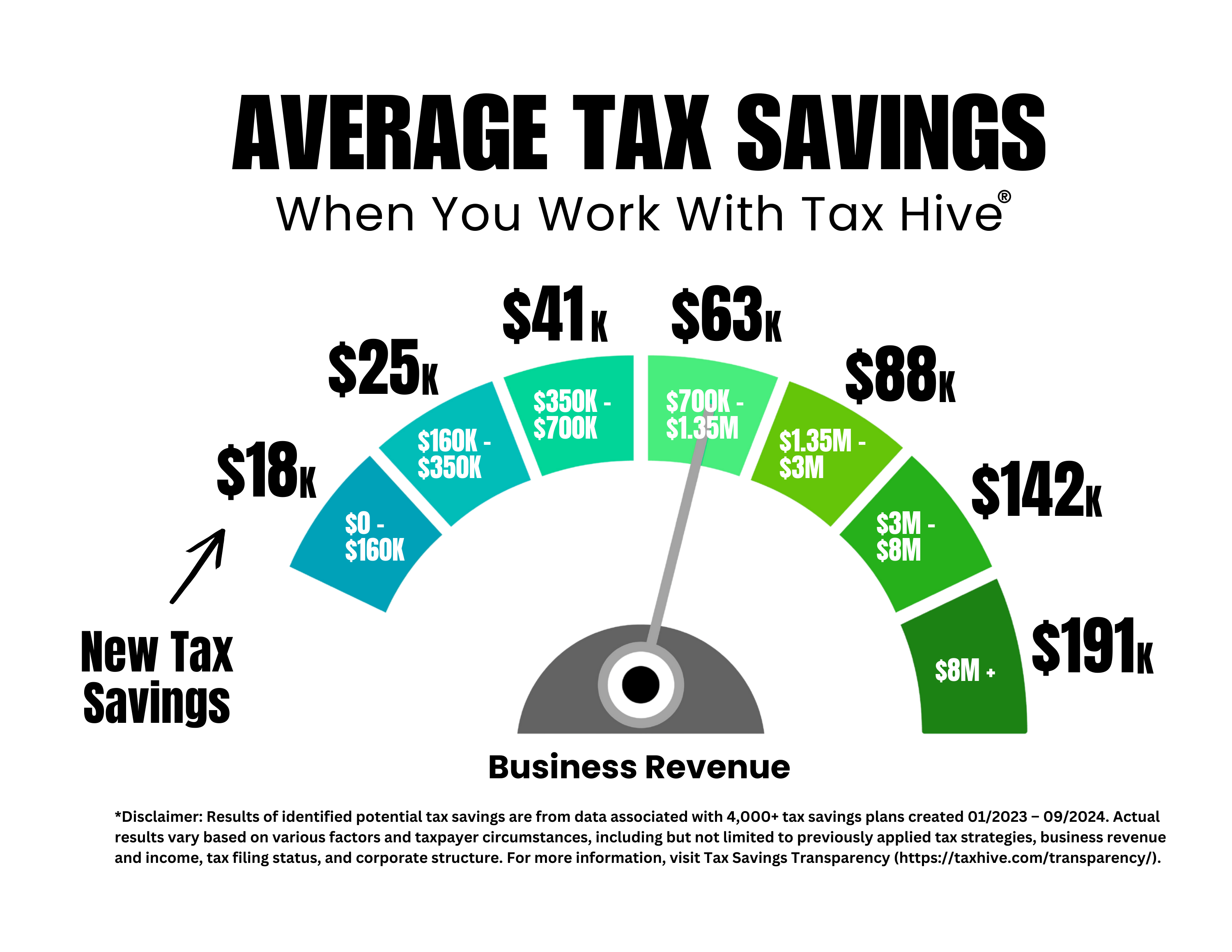

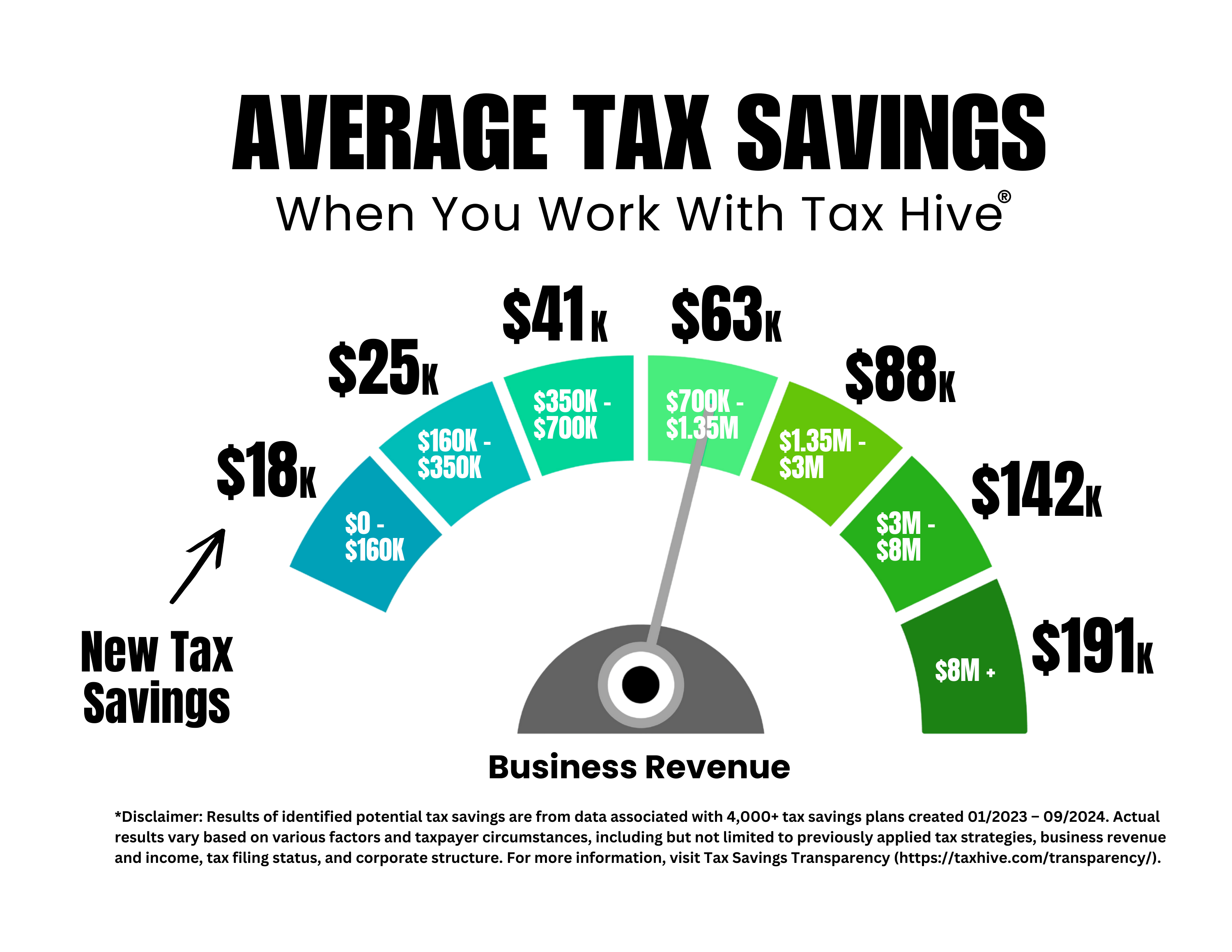

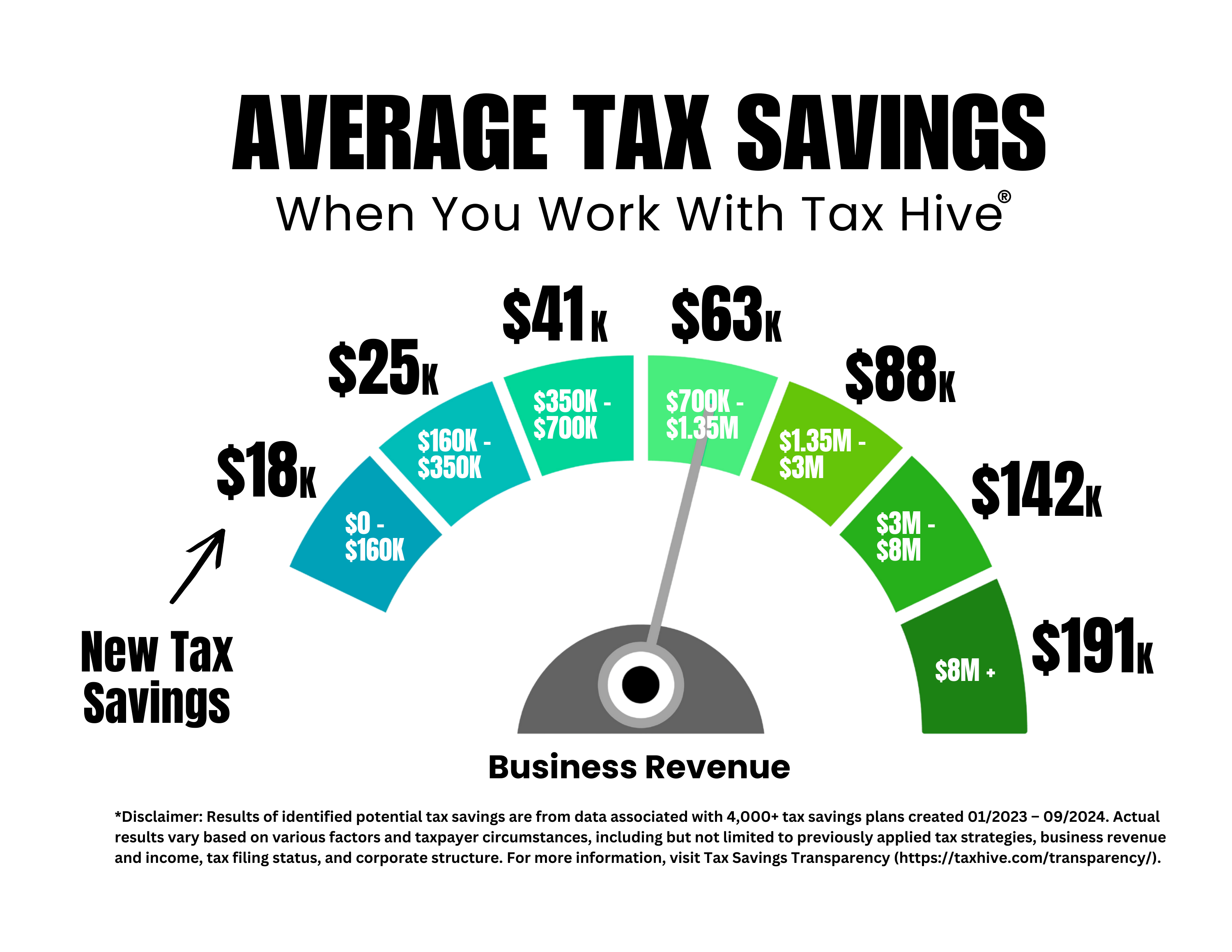

How much can I expect to save in taxes when I get a plan?

Because everyone’s situation is unique, we can’t promise you specific savings until reviewing your situation. However, the following graph can give you an idea of potential savings based on your annual business revenue.

What is the difference between the Strategic Tax Saving Plan and the Business Optimization Blueprint?

The Business Optimization Blueprint is a limited self-assessment designed to help you identify missing potential tax deductions. The result of the blueprint contains a list of missing potential tax deductions with pre-written answers reviewed and approved by licensed accounting and legal professionals. In 2022, we completed over 25,000 blueprints identifying an average in the tens of thousands per blueprint. In contrast, the Strategic Tax Plan is a comprehensive, strategic roadmap to overall tax savings (not just tax deductions). Our technology and team of experts consider thousands of tax strategy combinations. We review prior tax returns and check against 1,400 federal, state, and local tax deductions, credits, and programs. In 2022, our tax plans found an average estimated first year tax savings of $43,933. Schedule a free consultation today. Visit Tax Savings Transparency for more information.

Do I need an updated plan each year?

Because you, your business, and the tax code are constantly evolving and changing, we recommend you update your plan every year. Ask your account executive about discounted rates on updated plans.

Can I get a plan to see if my accountant is doing everything right?

Of course, we encourage it. Some of our clients simply want a “second opinion” to confirm their accountant, friend, or family member isn’t missing anything.

What if I have questions about getting a tax slashing plan?

We have a dedicated Account Executive Team that’s ready to help answer your questions. Schedule a call with us and we’ll be happy to answer all your questions.

What other business services does Tax Hive offer?

We offer traditional business tax preparation and tax filing services. In addition, we can help you with bookkeeping, audit response, entity formation, business cleanup, and business tax consulting and advice. We're here to help you keep your business moving forward.