Tax Hive Blog

Enjoy these timely and informative articles that can help you make informed decisions about your business.

IRS Rules About Charitable Organizations & Contributions

As a rule, Americans are generous people, and businesses support many of the charitable organizations in this country. Because the IRS allow …

Read More

Small Business and Solopreneur Payment Tools

With more businesses using employees working from home or outsourcing to freelancing independent contractors, solopreneurs are springing up …

Read More

Business Use of Social Media in Turmoil

Prior to the beginning of 2020, a business owner who wanted to have a business presence on social media sites found it easy and free to set …

Read More

How Long Should You Keep Records for the IRS?

It is never fun to talk about the IRS and those nasty “audits.” If you have ever been audited and worse owed them money, you may think that …

Read More

Business Asset Protection Keys

One of the great tragedies in creating and growing a business is to lose your assets, or the business due to overlooking or failing to prope …

Read More

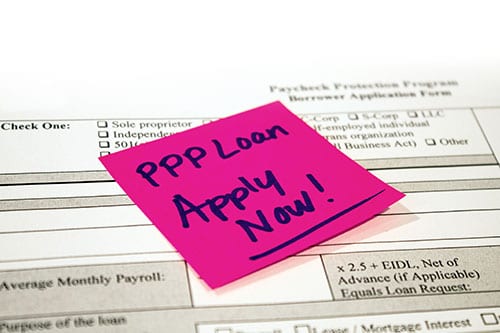

Round 2 – Paycheck Protection Program

The second round of PPP is in effecti, and certain eligible borrowers that received funding in the first round can apply for this second rou …

Read More

The Importance and Functions of Accounting and Audit in Today’s Business

If you have been in business for a while, you may recognize the functions and importance of accounting and audit. Perhaps there will be a co …

Read More

Using PPC to Make Your Website a Web Exit Instead of a Billboard

PPC, Pay-Per-Click, advertising is not for every business or website, but it is right for many. Too many business owners overlook PPC, usual …

Read More

Lease vs Purchase – Which is Right for Your Business?

Starting and operating a business involves a myriad of financial and operational decisions. When it comes to equipment used in the business, …

Read More

No Posts Found

Schedule a FREE Ask a Pro Consultation

On the call, we'll guide you through a self-assessment designed by tax advisors to help you identify potential business tax savings (*Ask about our guarantee).

START NOW